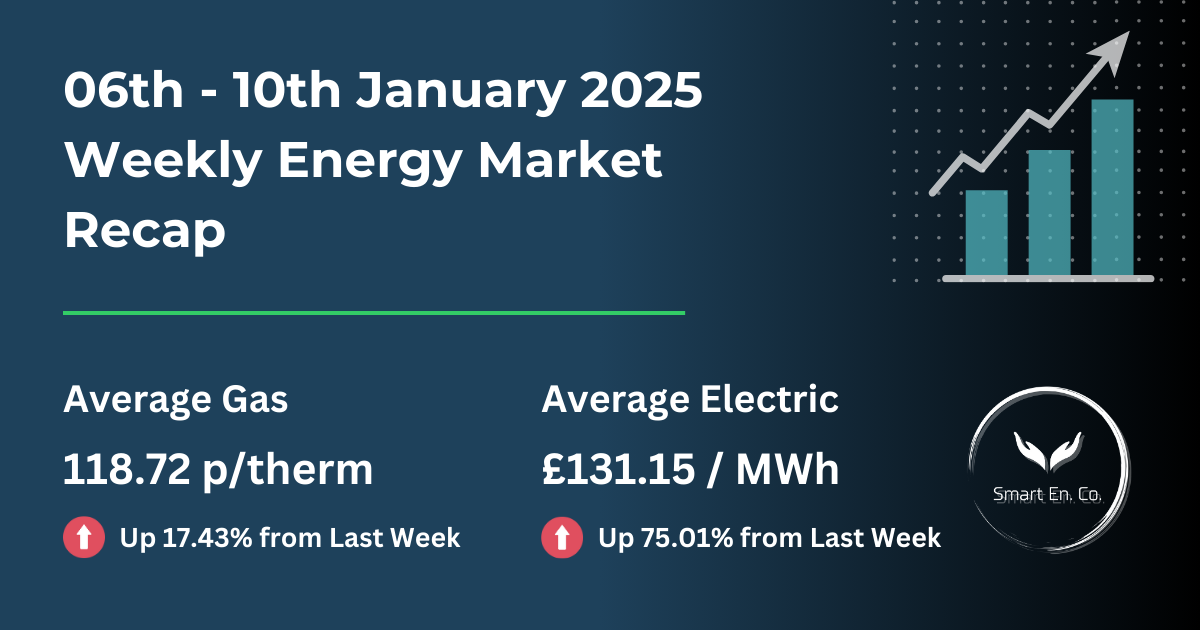

Weekly Energy Market Update: 06th - 10th January 2025

Weekly Energy Market Update: Comparing December 18th–22nd, 2024, to January 6th–10th, 2025

Overview of the Energy Market Comparison

As businesses returned after the holiday break, energy markets saw notable changes. Gas and electricity prices rose significantly, driven by colder weather and fluctuating wind generation, while oil prices saw modest increases. This blog will break down the key movements in gas and power markets, highlight trends over the past year, and explain how your business can capitalise on market opportunities.

Gas Market Insights

Average Gas Price:

- January 6–10, 2025: 118.72p/th

- December 18–22, 2024: 101.10p/th

- Change: +17.43%

Gas prices saw a sharp increase as colder weather returned after the holiday period, driving up residential and industrial heating demand. Reduced wind generation also led to increased reliance on gas-fired power plants to meet electricity needs.

Key Highlights:

- Demand Increases:

- Colder temperatures pushed residential and industrial demand higher.

- Gas-for-power demand surged midweek as wind generation dropped, creating additional pressure on gas supply.

- Supply Stability:

- LNG arrivals remained strong, with robust flows from Norway. However, small unplanned outages at facilities like Gullfaks temporarily tightened supply midweek.

- Daily Movements:

- Monday: Gas prices opened high at 124.15p/th, as demand increased sharply due to colder temperatures.

- Midweek: Prices fluctuated slightly as gas-for-power demand eased with a brief improvement in wind speeds.

- Friday: Prices stabilised at 116.0p/th as demand started to ease, and weather forecasts predicted milder conditions ahead.

Current State of Affairs:

The gas market remains well-supplied, but demand spikes caused by weather-driven factors, like colder temperatures and low wind generation, are creating volatility. However, with milder weather expected next week, prices may ease slightly in the short term.

Electricity Market Insights

Average Electricity Price:

- January 6–10, 2025: £131.15/MWh

- December 18–22, 2024: £74.91/MWh

- Change: +75.01%

Electricity prices surged significantly as colder weather coincided with reduced wind output early in the week, forcing a heavier reliance on gas-fired power plants.

Key Highlights:

- Wind Generation Volatility:

- Wind speeds dropped significantly early in the week, reducing renewable power availability and increasing demand for gas-fired power stations.

- Later in the week, wind generation improved slightly, easing pressure on prices.

- Temperature-Driven Demand:

- Colder temperatures increased heating demand, pushing electricity consumption higher, especially during early January’s cold spell.

- Daily Movements:

- Monday: Electricity prices started at £109.87/MWh as demand rose sharply.

- Midweek: Prices peaked at £188.77/MWh on Thursday, driven by low wind generation and high demand.

- Friday: Prices stabilised slightly at £106.32/MWh as wind speeds picked up and heating demand eased.

Current State of Affairs:

The electricity market remains volatile, heavily influenced by renewable output and weather conditions. With wind generation forecast to improve next week, prices could stabilise, but colder periods may still cause temporary spikes.

Oil Market Summary

Average Brent Crude Price:

- January 6–10, 2025: £76.20/barrel

- December 18–22, 2024: £72.10/barrel

- Change: +5.68%

Oil prices saw moderate increases this week, driven by increased heating demand in Europe and the U.S., alongside Chinese economic stimulus measures.

Key Highlights:

- Heating Demand: Cold weather in major markets boosted demand for heating fuels, adding upward pressure to prices.

- Geopolitical Tensions: U.S. sanctions targeting Russia’s oil industry and supply constraints from OPEC nations further tightened the market.

- Economic Stimulus: China’s economic growth initiatives, including wage increases and funding boosts, raised expectations of higher demand.

Current State of Affairs:

Oil prices are relatively stable compared to gas and electricity, offering businesses a predictable cost environment for now. However, geopolitical risks could still impact prices in the medium term.

12-Month Wholesale Market Trends

Understanding the Long-Term View

The graph below illustrates how wholesale gas (grey line) and electricity (blue line) prices have fluctuated over the past 12 months.

Key Trends:

- Gas Prices: Gradual increases over the year, with occasional spikes during colder periods. Current prices are higher than the 12-month average, reflecting seasonal demand.

- Electricity Prices: Highly volatile, with significant peaks during periods of reduced wind generation and increased demand. The January spike highlights how quickly prices can rise in colder weather.

What This Means for You:

If your business’s contract end date (CED) is approaching, now is a good time to explore fixing your rates. Remember, you can secure your next fixed contract up to 12 months before your CED, allowing you to capitalise on favourable market movements and avoid potential price spikes later in the year.

Upcoming Week Forecast

Here’s what to watch in the energy markets next week (13th–17th January 2025):

Gas Market Forecast:

- Milder Weather Ahead: Forecasts suggest a return to milder temperatures, which could reduce residential and industrial heating demand.

- Stable LNG Supplies: Continued strong LNG arrivals and high Norwegian imports are expected to balance the market, which may ease prices.

- Short-Term Volatility: Brief colder spells or unexpected supply issues could still cause temporary price spikes.

Electricity Market Forecast:

- Improved Wind Generation: Wind speeds are forecast to rise above seasonal averages, reducing reliance on gas-fired power plants. This could stabilise electricity prices or even bring them lower.

- Demand Moderation: Milder weather may lower heating demand, easing pressure on the electricity grid.

Recommendation: Is It the Right Time to Renew?

Gas Contracts:

- Gas prices are elevated due to cold weather and increased demand but may ease with milder forecasts next week.

- Recommendation: If your renewal isn’t urgent, consider waiting for potential price dips in the coming weeks.

Electricity Contracts:

- Electricity prices remain volatile, driven by weather-dependent wind generation. Improved renewable output next week may stabilise rates.

- Recommendation: Hold off on long-term renewals and monitor market conditions for potential improvements.

Fix Early for Better Rates:

Remember, you can secure your next fixed contract up to 12 months before your CED. Fixing early allows you to take advantage of favourable market movements and protect your business from sudden price surges.

Key Takeaways for Businesses

- Gas Prices: Higher seasonal demand is keeping prices elevated, but milder weather next week could ease pressure.

- Electricity Prices: Wind generation improvements may stabilise prices, but watch for short-term volatility.

Have questions or need personalised advice? Contact us today to discuss your energy needs and secure the best rates for your business.

Empower Your Energy Choices

Why Choose Smart Energy Company?

Trusted Expertise

Real-Time Insights

Personalised Support

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business