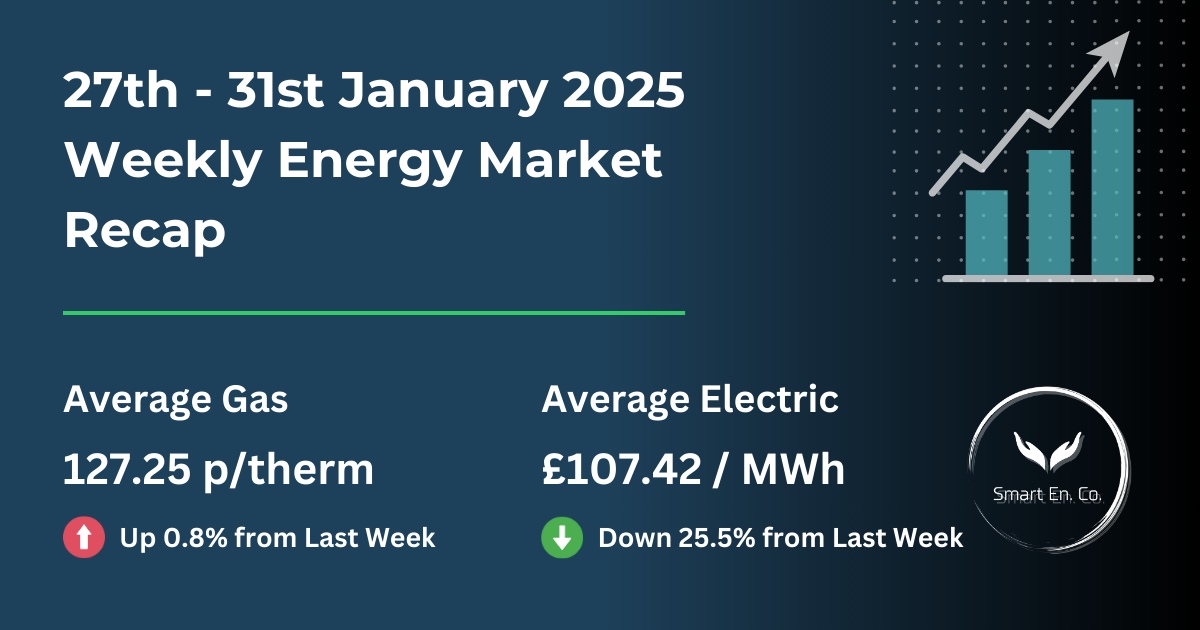

Weekly Energy Market Update: 27th - 31st January 2025

Key Data at a Glance

Overview of the Energy Market Comparison

This week saw further market volatility, with gas prices rising by 0.8% and electricity prices falling by 25.5% from last week’s average. While gas prices remained elevated due to supply concerns, electricity prices declined as wind generation improved after last week’s surge. Geopolitical uncertainty, Norwegian supply disruptions, and fluctuating LNG arrivals continued to shape the energy landscape.

Gas Market Insights

Average Gas Price:

- 27th–31st January 2025: 127.25p/th

- 20th–24th January 2025: 126.25p/th

- Change: +0.8%

Key Highlights:

- Supply Disruptions & Storage Levels:

- Medium storage levels fell to 22%, raising supply concerns early in the week.

- Gullfaks' extended 13mcm/d outage pressured the market before resolving.

- LNG Sendouts & Pipeline Flows:

- LNG sendouts fluctuated, dropping by 11mcm/d before stabilising.

- Norwegian pipeline flows increased, helping ease midweek supply constraints.

- Demand Factors:

- Lower wind output increased gas-for-power demand, especially midweek.

- Colder temperatures in Europe added upward pressure to gas prices.

Daily Gas Market Movements:

- Monday: Gas opened at 126.40p/th, rising on supply concerns.

- Tuesday: Prices softened to 121.85p/th as supply stabilised and storage switched to injections.

- Wednesday-Thursday: Prices rebounded to 131.00p/th as outages persisted and demand rose.

- Friday: Gas hit 133.90p/th, its highest in two weeks, before settling slightly lower.

Electricity Market Insights

Average Electricity Price:

- 27th–31st January 2025: £107.42/MWh

- 20th–24th January 2025: £144.27/MWh

- Change: -25.5%

Key Highlights:

- Wind Generation & Demand Changes:

- Stronger wind output helped reduce reliance on gas-fired power generation.

- A mild weather forecast led to lower peak electricity demand.

- Supply Side Stability:

- UK nuclear output remained steady at 4.4GW, supporting baseload supply.

- Norwegian pipeline flows and LNG arrivals helped maintain grid stability.

- Volatility in Daily Prices:

- Midweek volatility saw electricity prices spike to £241.49/MWh before dropping.

- By Friday, prices stabilised at £130.70/MWh, reflecting improved renewable generation.

Daily Electricity Market Movements:

- Monday: Prices started at £90.82/MWh, tracking stable gas markets.

- Wednesday: A surge in gas-for-power demand pushed electricity to £241.49/MWh, the week’s peak.

- Friday: Electricity settled at £130.70/MWh, supported by strong wind generation.

Oil Market Summary

Brent Crude Price:

- 27th–31st January 2025: $76.54/barrel

- 20th–24th January 2025: $78.29/barrel

- Change: -2.2%

Key Highlights:

- Trump’s Energy Policies:

- Calls for increased U.S. domestic production pressured global oil prices.

- Proposed 25% tariffs on Canadian and Mexican crude created uncertainty.

- Supply & Demand Factors:

- China’s weak economic data dampened global demand outlook.

- U.S. crude stockpiles increased by 3.5 million barrels, adding bearish pressure.

- Outlook:

- OPEC+ meeting on 3rd February could bring new production adjustments.

12-Month Wholesale Market Trends

Understanding the Long-Term View

The graph below highlights how wholesale gas (grey line) and electricity (blue line) prices have fluctuated over the past year.

Key Trends:

- Gas Prices: Remain elevated but show signs of stabilising.

- Electricity Prices: Spiking during high gas demand periods but fluctuating with renewables.

What This Means for Businesses:

With prices still

above long-term averages, businesses should

monitor trends closely and consider securing contracts in advance.

Upcoming Week Forecast

Gas Market:

- Mild Weather Expected: Reduced heating demand may limit price spikes.

- LNG Arrivals: A steady flow of cargoes could help stabilise prices.

Electricity Market:

- Higher Wind Output Forecast: Could lead to lower gas-for-power demand.

- Industrial Demand: Expected to remain stable, keeping prices in check.

Oil Market:

- OPEC+ Meeting on 3rd Feb: Could set the tone for near-term oil price movements.

- Market Watching Trump’s Tariff Decisions: Potential volatility remains.

Recommendation: Is It the Right Time to Renew?

Gas Contracts:

- Prices are stabilising but remain high.

- Recommendation: If your renewal is in the next 6 months, consider fixing now before demand increases again.

Electricity Contracts:

- Prices have softened but remain volatile.

- Recommendation: Businesses with contracts ending in 2025 should start monitoring renewal options.

Fix Early for Better Rates:

You can secure your next fixed contract up to 12 months before your CED. This allows you to capitalise on market dips and avoid future price surges.

Key Takeaways for Businesses

- Gas Prices: Stabilising but still high—monitor closely for renewal opportunities.

- Electricity Prices: Dropped this week but remain volatile—timing is key.

- Oil Prices: Slightly down—OPEC+ decisions may impact future costs.

Contact us today to discuss your energy strategy and secure the best rates for your business.

Empower Your Energy Choices

Why Choose Smart Energy Company?

Trusted Expertise

Real-Time Insights

Personalised Support

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business

Find the Best Energy Deal for Your Business Today

We partner with 28+ trusted UK suppliers to give you a full market comparison—No pushy sales, no hidden fees. Get a tailored quote and start saving.

This is a lead generation LP