January 2025 UK Energy Market Trends: Gas, Power, and Oil

January 2024 UK Energy Market Trends: Gas, Power, and Oil

January 2025 brought volatile energy prices across the UK, driven by fluctuating demand, supply concerns, and geopolitical uncertainty. While gas and electricity prices initially spiked due to colder weather, a shift in forecasts and stable supply helped bring some balance to the market.

This report breaks down the key trends in gas, power, and oil markets, comparing them to December’s figures and looking ahead to February.

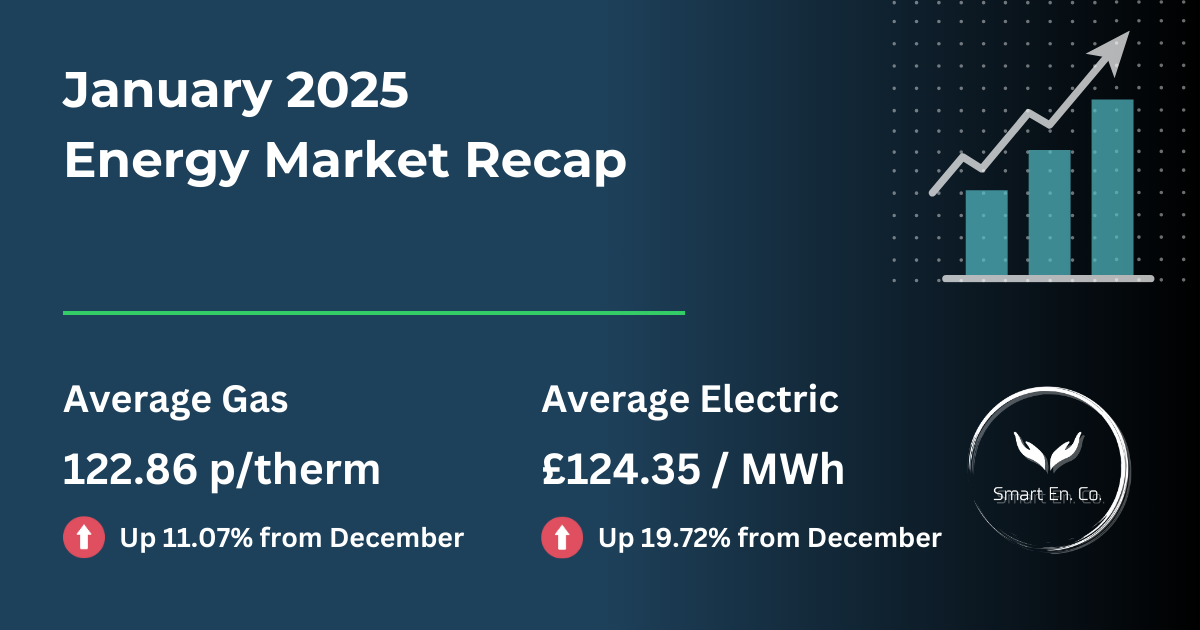

Key Highlights for January 2025

- Gas Prices: Averaged 122.86p/th, a 11.07% increase from December’s 110.61p/th. Cold weather and lower wind generation led to stronger demand.

- Electricity Prices: Averaged 124.35/MWh, rising 19.72% from December’s 103.87/MWh, driven by intermittent renewable output and a mid-month price spike.

- Oil Prices: Brent crude traded between $72 and $81 per barrel, with markets reacting to sanctions on Russian oil, U.S. economic policies, and China’s demand outlook.

Gas Market Overview

Gas Price Movements in January

Gas prices rose significantly compared to December, reflecting higher demand during cold spells and geopolitical concerns affecting supply chains. However, increased LNG arrivals and strong Norwegian imports helped stabilise the market towards the end of the month.

🔹

Highest Price: 133.90p/th (31 January)

🔹

Lowest Price: 114.50p/th (13 January)

🔹

January Average: 122.86p/th (+10.07% vs. December)

Key Drivers Behind Gas Prices

- Cold Weather Impact:

- Early January saw freezing temperatures, driving up heating demand and increasing gas-for-power generation.

- Mid-month forecasts indicated milder conditions, easing price pressures.

- Supply & LNG Arrivals:

- LNG deliveries remained strong, preventing supply shortages.

- Norwegian imports remained robust, despite occasional outages at key fields.

- Geopolitical Factors:

- Russian LNG export disruptions and discussions about further sanctions from the EU and U.S. created market uncertainty.

- Colder conditions in the U.S. led to supply tightness, impacting global LNG prices.

Power Market Overview

Electricity Price Movements in January

Electricity prices fluctuated throughout January, with notable spikes around mid-month due to weaker wind generation. The highest price reached £241.49/MWh on 22 January, reflecting tight supply conditions.

🔹

Highest Price: £241.49/MWh (22 January)

🔹

Lowest Price: £88.81/MWh (7 January)

🔹

January Average: £124.35/MWh (+19.72% vs. December)

Key Drivers Behind Power Prices

- Wind Generation Volatility:

- Lower wind speeds mid-month increased reliance on gas-fired power, pushing prices up.

- Wind output picked up later in the month, bringing prices back down.

- Gas-for-Power Demand:

- Higher gas prices led to expensive power generation, particularly in periods of low renewable output.

- Colder Spells and Heating Demand:

- Colder-than-expected weather in early and mid-January

increased electricity consumption.

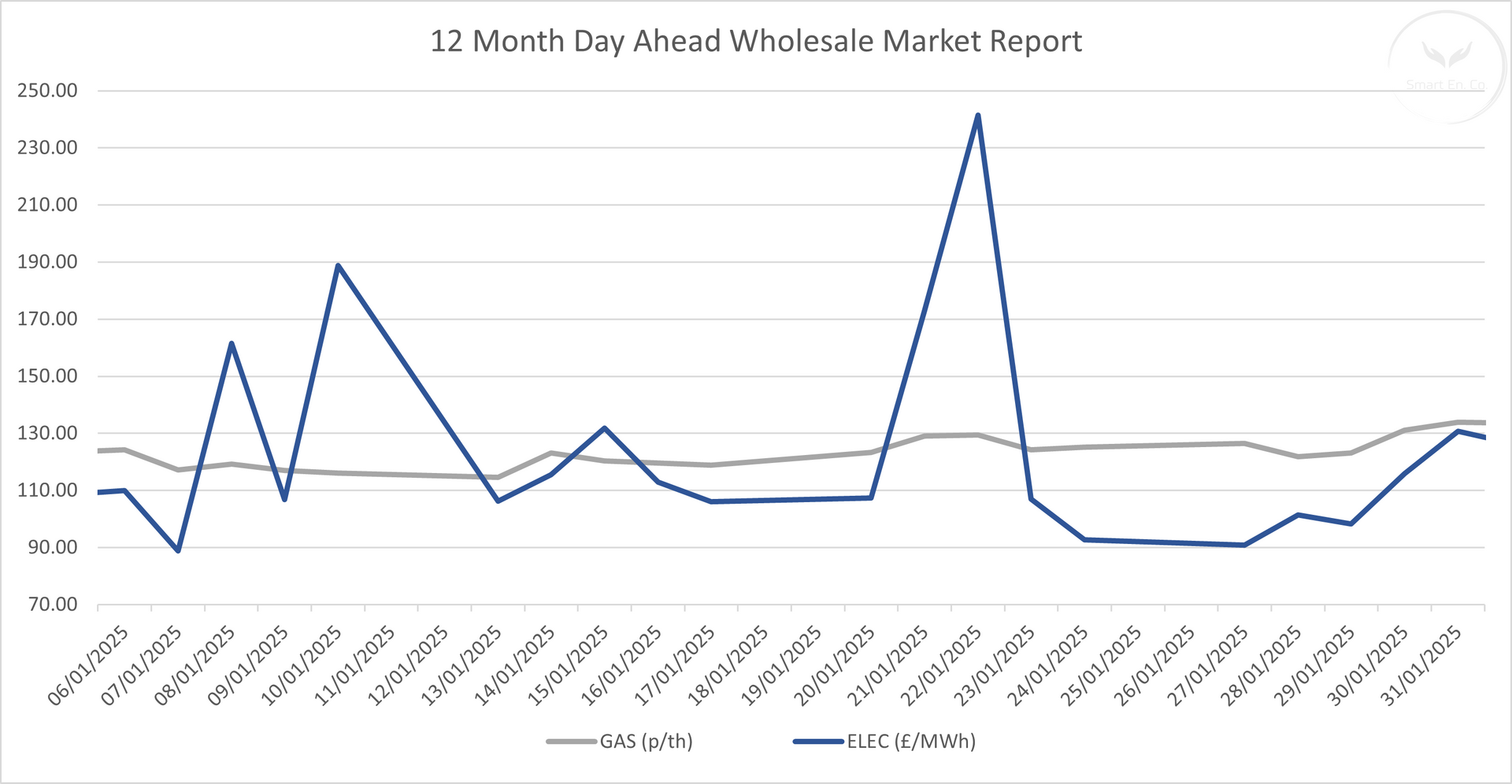

Monthly Price Movements – Gas & Electricity

To illustrate how wholesale prices fluctuated throughout the month, here’s a graph of January’s daily gas and power prices:

This visual representation highlights:

✅ Significant

spikes in electricity prices mid-month.

✅

Gas price stability towards the end of January.

✅ The impact of

cold spells and wind generation on market volatility.

Oil Market Overview

Oil Price Trends in January

Brent crude prices fluctuated between $72 and $81 per barrel, reacting to supply concerns and global economic policies.

🔹

Highest Price: $81.01 per barrel (14 January)

🔹

Lowest Price: $72.62 per barrel (30 January)

🔹

January Average:

$76.50 per barrel

Key Drivers Behind Oil Prices

- Sanctions on Russian Oil:

- The U.S. expanded sanctions on Russian energy exports, disrupting some supply chains.

- European buyers sought alternative suppliers, boosting demand for Middle Eastern oil.

- China’s Economic Outlook:

- Chinese economic stimulus plans provided some price support, though concerns over slowing industrial demand remained.

- OPEC+ & U.S. Policies:

- OPEC+ production levels remained stable, preventing sharp price swings.

- President Trump’s energy policies created uncertainty about future U.S. oil production and tariffs.

12-Month Energy Market Trends

The energy market in 2024 and early 2025 has been marked by significant volatility. The graph below illustrates wholesale gas (grey line) and electricity (blue line) price trends over the past year.

This

visual overview shows how seasonal demand,

supply changes,

and external factors have impacted prices.

Looking Ahead: February 2025 Forecast

As we move into February 2025, businesses should prepare for potential market movements based on the following:

✔️ Weather Expectations:

- February is expected to be milder than January, which could reduce gas demand.

- However, intermittent wind generation may still impact electricity prices.

✔️ LNG & Norwegian Imports:

- LNG deliveries remain strong, helping stabilise supply.

- Norwegian flows are expected to remain high, barring any unexpected maintenance.

✔️ Geopolitical Risks:

- Ongoing sanctions on Russian LNG and potential policy shifts in the U.S. could influence energy prices.

What this means for your business: Now is a crucial time to review energy contracts and explore procurement strategies before potential price swings later in Q1 2025.

Why Choose The Smart Energy Company?

Navigating the energy market can be challenging, especially with ongoing volatility. At The Smart Energy Company, we provide businesses with expert insights, tailored energy procurement solutions, and access to competitive rates.

Get ahead of the market today!

- Sign up for monthly energy market reports to stay informed on the latest trends.

- Request a free energy quote and see how much your business could save.

Conclusion

December 2024 highlighted the importance of understanding market trends to navigate energy price fluctuations effectively. By keeping an eye on key drivers such as weather, supply, and geopolitical developments, businesses can make informed decisions.

For personalised guidance and support, trust The Smart Energy Company to help your business thrive, no matter the market conditions.

Need Tailored Advice for Your Business?

Contact us today at 0151 459 3388 or request your free energy quote and stabilise your energy costs. At Smart Energy Company, we specialise in finding the best utility contracts for your business, ensuring you never miss a renewal and always get the best deals.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business