Weekly Energy Market Update: 24th - 28th February 2025

Market Overview: Gas Prices Hit a 2025 Low as Electricity Prices Decline Further

A Quick Look at This Week’s Energy Market

✨

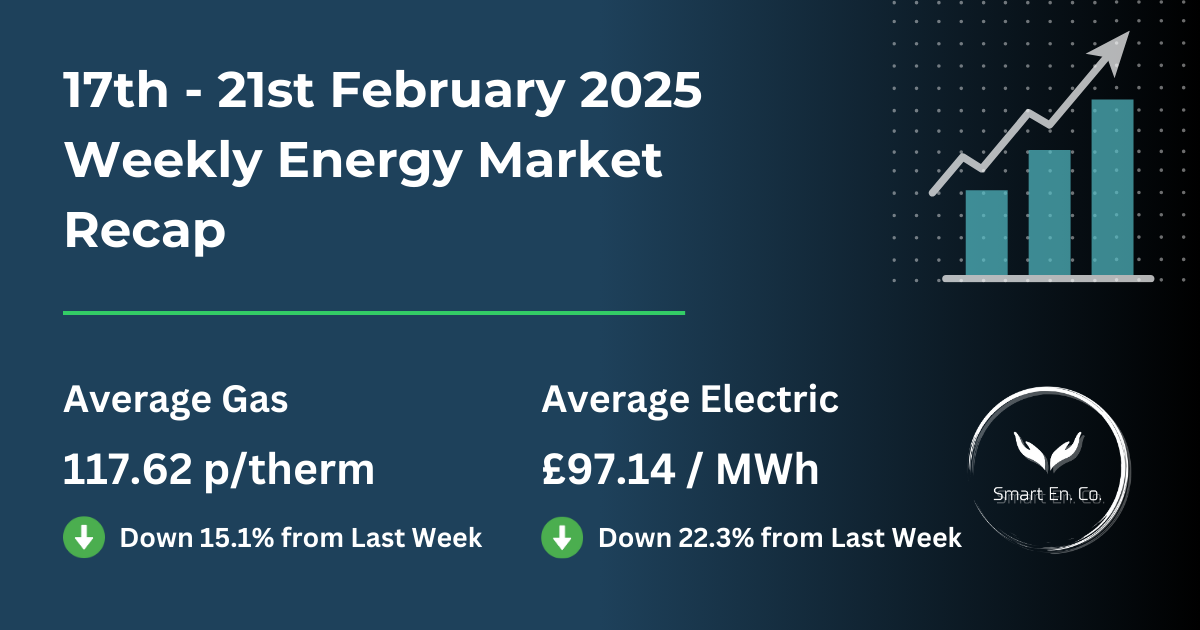

Gas prices: 107.47 p/therm (down from 117.62 last week, an 8.6% decrease)

✨

Electricity prices: £93.46 / MWh (down from £97.14 last week, a 3.8% decrease)

Gas and electricity prices continued their downward trend this week, with gas hitting its lowest price of 2025 so far. Electricity prices also declined, reflecting stronger renewable generation and milder temperatures.

Why Are Prices Falling?

- Gas demand is lower due to milder temperatures and increased renewable energy output.

- LNG supply is strong, with multiple cargoes arriving and more scheduled for the coming weeks.

- Electricity demand is easing, with wind and solar contributing more to the grid.

- Geopolitical tensions appear to be stabilising, reducing risk premiums in the market.

Despite these factors, energy prices remain unpredictable, and businesses should monitor trends closely.

Should You Lock In Your Next Energy Contract?

💡 If your contract is ending in the next 3 months ➔ Prices are falling, making it a good time to explore fixed-rate options. Locking in now could protect your business from any unexpected market rebounds.

📅 If your contract isn’t due until later in 2025 ➔ Continue monitoring the market. While prices are falling, long-term trends remain uncertain. We can track the market for you and alert you when the best time to switch comes.

❗ If you’re currently out of contract ➔ Act fast. Out-of-contract rates remain significantly higher than fixed deals, and waiting could result in higher costs.

What’s Likely to Happen Next? (Market Forecast for 3rd - 8th March 2025)

🔼 Gas prices may stabilise as demand remains low and supply is strong. However, any supply disruptions or colder-than-expected weather could cause a rebound.

🔻

Electricity prices could drop further if wind generation remains high. However, fluctuations in renewable output could still create short-term price spikes.

🌍

Global factors remain uncertain — any unexpected geopolitical events could push prices higher again.

Biggest Risk? Uncertainty. Markets can shift quickly, so businesses should stay informed and act when opportunities arise.

Oil Market Update

📊

Brent crude: $74.04/barrel (slightly up this week)

📊

WTI crude: $70.35/barrel (small increase this week)

Key factors affecting oil prices:

✔

New U.S. sanctions on Iran have created concerns about supply shortages.

✔

Russia-Ukraine peace talks continue, which could ease sanctions and increase Russian oil exports.

✔

Venezuela sanctions update: The U.S. revoked Chevron’s licence to operate, impacting global oil supply.

Why does this matter? Oil prices can influence gas and electricity markets, affecting overall energy costs.

12-Month Energy Market Trends

🔍 Looking at the past year, gas and electricity prices have seen a clear upward trend, with some sharp spikes in late December and January. While the market has somewhat stabilised in recent weeks, prices remain much higher than mid-2024 levels.

📊

Key trends from the past 12 months:

✔ Gas prices - Gradual increase throughout the year, with notable peaks during winter demand periods.

✔

Electricity prices - More volatile, with extreme price surges in December and January before settling slightly.

✔ The market has responded strongly to weather changes, supply levels, and global events.

What does this mean for businesses? Prices are still high compared to last year, so waiting for a significant drop could be risky. While the market has eased in the short term, the overall trend suggests that securing a contract now could provide stability against potential future increases.

(See the attached 12-month market graph for a full breakdown of movements.)

Next Steps: What Should You Do Now?

✔️

Send us your latest bill – we’ll review your options and see if fixing now makes sense.

✔️

Not ready to switch? Let us track the market for you – We can track the market for you and notify you when prices move in your favour.

✔️

Get expert guidance – we work with over 28 suppliers to find the best deal for your business.

📩

Contact us today to discuss your energy contract options and secure your business against further price increases.

Final Thoughts

Energy prices have continued to fall, but the market remains unpredictable. If you’re considering fixing your rates, now could be a good time to explore your options.

If you’re unsure whether now is the right time to renew, Smart Energy Company can provide a no-obligation energy review to help you make an informed decision.

📧

Get in touch today to explore your options and ensure your business is on the best possible energy contract.

Empower Your Energy Choices

Why Choose Smart Energy Company?

Trusted Expertise

Real-Time Insights

Personalised Support

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business