February 2025 UK Energy Market Trends: Gas, Power, and Oil

February 2025 Wholesale Energy Market Report

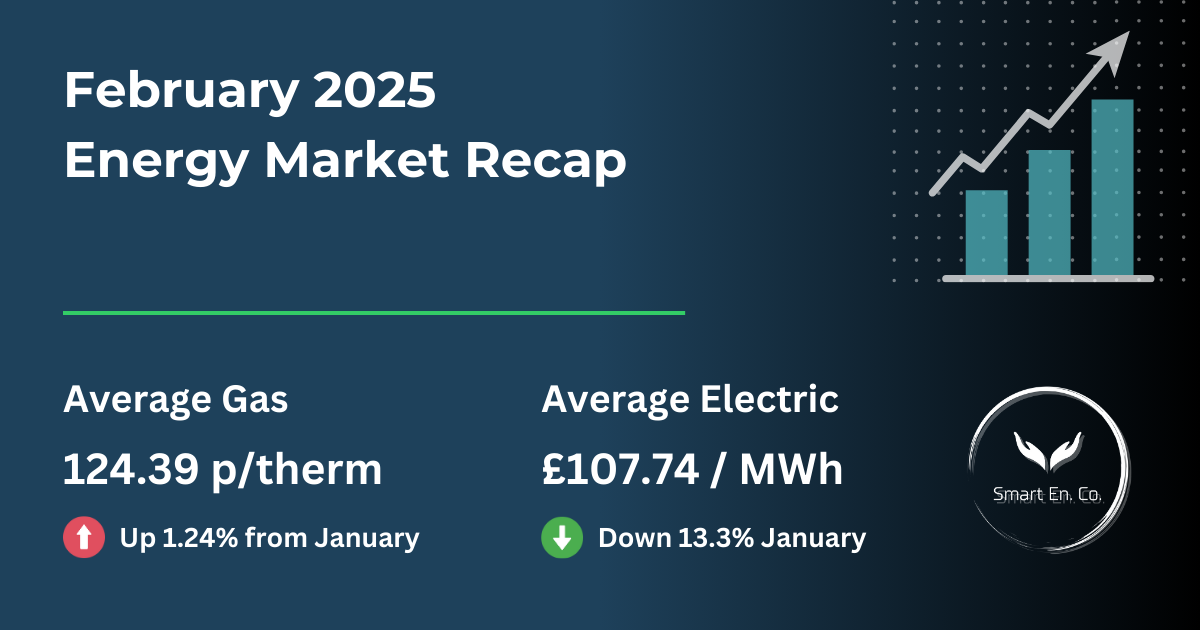

February 2025 saw notable shifts in UK energy markets, with gas and electricity prices experiencing significant volatility. Milder temperatures and strong LNG arrivals kept prices in check, but intermittent renewable output and geopolitical developments added uncertainty.

This report provides an in-depth analysis of February's energy market trends, comparing them to January and outlining key factors that influenced gas, power, and oil prices.

Key Takeaways

- Gas prices rose slightly to 124.39p/th, but supply remained stable.

- Electricity prices fell 13.3% to 107.74/MWh, largely due to improved renewable generation.

- Oil prices fluctuated between $68.62 and $76.48 per barrel, influenced by geopolitical factors.

- Businesses should consider locking in contracts before Q2 price movements.

UK Gas Price Trends & Procurement Advice (Feb 2025)

Gas Price Movements in February

Gas prices exhibited fluctuations throughout February, with an initial downward trend followed by an uptick mid-month due to colder weather forecasts and temporary supply concerns.

- Highest Price: 145.30p/th (11 February)

- Lowest Price: 100.05p/th (27 February)

- February Average: 124.39p/th (+1.24% vs. January)

Key Drivers Behind Gas Prices

Weather & Demand Trends:

- Milder-than-expected temperatures early in the month led to reduced gas demand.

- A mid-month cold snap increased consumption, pushing prices higher.

Supply & LNG Arrivals:

- LNG sendout remained strong, with consistent shipments supporting the market.

- Norwegian flows fluctuated due to maintenance, briefly tightening supply mid-month.

Geopolitical Influence:

- Tensions in Ukraine impacted global energy supply expectations.

- The Red Sea shipping disruptions briefly raised concerns about LNG cargo arrivals.

Best Time to Lock in Contracts?

With

March forecasts predicting mild temperatures and stable LNG arrivals, businesses should monitor market movements. If gas prices remain stable in early March,

this could be a strategic window to secure a contract before potential volatility in Q2.

UK Electricity Prices Drop 13.3% – What This Means for Businesses

Electricity Price Movements in February

Electricity prices were volatile, but overall, the average dropped significantly compared to January due to improved renewable output.

- Highest Price: 129.50/MWh (13 February)

- Lowest Price: 69.87/MWh (24 February)

- February Average: 107.74/MWh (-13.3% vs. January)

Key Drivers Behind Power Prices

Renewable Generation:

- Strong wind generation helped stabilise prices for most of the month.

- Lower wind speeds in mid-February led to temporary price spikes as reliance on gas-fired power increased.

Gas-for-Power Demand:

- Lower gas prices towards the end of February contributed to reduced electricity costs.

- A brief period of higher gas-for-power demand in mid-month coincided with colder temperatures and reduced wind output.

Weather & Consumption:

- Milder temperatures in the latter part of February reduced electricity demand.

- Increased solar output provided additional downward pressure on prices.

What Businesses Should Do Now

With electricity prices

13.3% lower than January, this could be a

good time to review current energy contracts and explore options for locking in a lower rate before demand increases in the summer months.

Monthly Price Movements – Gas & Electricity

To illustrate how wholesale prices fluctuated throughout the month, here’s a graph of February’s daily gas and power prices:

📉

Significant mid-month price spikes for both gas and electricity.

📉

Sharp electricity price decline towards the end of February.

📈

Correlation between gas and power market trends, particularly during colder periods.

Oil Market Overview

Oil Price Trends in February

Oil prices moved within a broad range throughout the month due to geopolitical and economic influences.

- Highest Price: $76.48 per barrel (21 February)

- Lowest Price: $68.62 per barrel (27 February)

- February Average: $72.89 per barrel

Key Drivers Behind Oil Prices

✔️ Geopolitical Events: Sanctions on Russian and Iranian oil exports created uncertainty in global supply chains.

✔️

Market Policies: OPEC+ maintained steady production levels, preventing dramatic price swings.

✔️

Global Demand: Mixed economic signals from China and the U.S. influenced investor confidence in oil markets.

Wholesale Energy Prices Over the Last 12 Months – Insights for 2025

The UK energy market has experienced significant fluctuations over the past 12 months. The graph below illustrates long-term trends in wholesale gas (grey line) and electricity (blue line) prices:

📉

Electricity prices peaked in December but showed stability in late February.

📈

Gas prices trended upwards through early winter but showed signs of recovery.

📊

Signs of market stabilisation suggest potential price corrections ahead.

Looking Ahead: March 2025 Forecast

As we move into March 2025, businesses should prepare for potential market shifts based on the following:

✔️ Weather Expectations:

- Forecasts indicate continued mild conditions, which may help keep gas and electricity prices stable.

- Wind generation is expected to remain strong, reducing reliance on gas-fired power.

✔️ Supply & Demand Factors:

- LNG arrivals are forecasted to remain steady.

- Norwegian supply stability will be crucial in maintaining balanced prices.

✔️ Geopolitical & Policy Influences:

- Ongoing U.S. sanctions and potential energy policy shifts may impact oil and gas markets.

- The resolution of Red Sea shipping disruptions could ease supply constraints.

Final Advice for Businesses

If you haven’t reviewed your energy contract yet, now may be a good time to secure a competitive rate before potential price swings in Q2.

Why Choose The Smart Energy Company?

With energy markets fluctuating daily, knowing when to renew or switch suppliers is key. At The Smart Energy Company, we help businesses secure the right contract at the right time—without the hassle of navigating volatile markets alone.

✅

Real-time market updates and expert analysis.

✅

Tailored procurement solutions to secure competitive rates.

✅

Proactive contract management to optimise savings.

📩 Get ahead of the market today!

Conclusion

February 2025 highlighted the importance of tracking energy market trends to make informed procurement decisions. By monitoring key drivers such as weather patterns, supply dynamics, and geopolitical risks, businesses can better navigate market volatility.

📞 Want personalised insights on when to secure your next contract? Get in touch today for a no-obligation review of your business energy rates.

Need Tailored Advice for Your Business?

Contact us today at 0151 459 3388 or request your free energy quote and stabilise your energy costs. At Smart Energy Company, we specialise in finding the best utility contracts for your business, ensuring you never miss a renewal and always get the best deals.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business