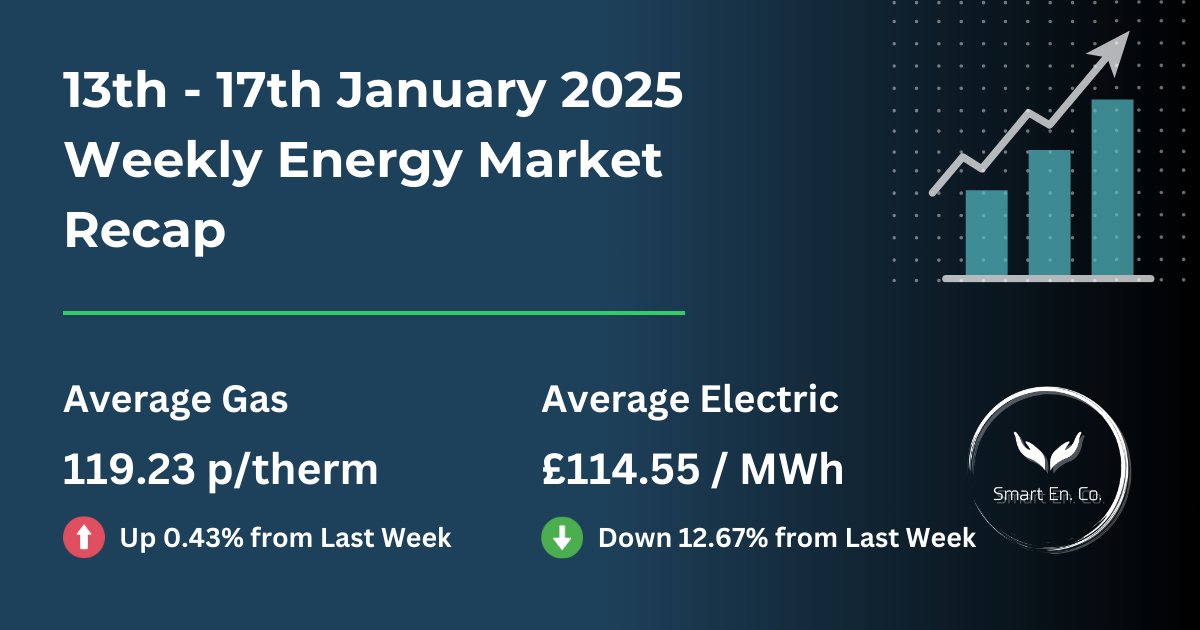

Weekly Energy Market Update: 13th - 17th January 2025

Key Data at a Glance

Overview of the Energy Market Comparison

This week’s energy markets displayed mixed movements, with gas prices showing slight gains while electricity prices appeared to ease due to fewer anomalies. Despite this, electricity prices remain above £100/MWh overall, reflecting ongoing volatility in the market. Meanwhile, oil prices experienced fluctuations driven by geopolitical tensions and strong heating demand.

Gas Market Insights

Average Gas Price:

- 13th–17th January 2025: 119.23p/th

- 6th–10th January 2025: 118.72p/th

- Change: +0.43%

Gas prices rose slightly this week, primarily driven by colder temperatures, increased heating demand, and geopolitical factors impacting the market.

Key Highlights:

- Colder Weather: Temperatures peaked midweek and then began falling, increasing residential and industrial demand for gas.

- Geopolitical Tensions: Reports of drone attacks on Russian gas infrastructure and potential U.S. sanctions targeting Russian LNG exports created upward pressure on prices.

- Supply Conditions:

- Strong LNG arrivals supported the market, with 7–8 cargoes expected over the next 10 days.

- Withdrawals from storage continued as demand outpaced local supply.

Daily Movements:

- Monday (13th): Gas prices softened to a weekly low of 114.50p/th, as renewable generation and reduced heating demand eased pressure.

- Tuesday (14th): Prices spiked to 123.03p/th, the largest single-day increase since August 2024, due to colder weather and geopolitical concerns.

- Friday (17th): Prices closed at 118.80p/th, stabilising slightly as weather forecasts predicted warmer conditions from 20th January onwards.

Electricity Market Insights

Average Electricity Price:

- 13th–17th January 2025: £114.55/MWh

- 6th–10th January 2025: £131.15/MWh

- Change: -12.67%

Electricity prices appeared to decline this week due to fewer price anomalies in the data. However, the market remains above £100/MWh, reflecting continued volatility.

Key Highlights:

- Renewable Generation: Improved wind output early in the week helped lower gas-for-power demand.

- Demand Volatility: Midweek colder temperatures and reduced wind generation temporarily increased prices before stabilising toward the weekend.

- Outlook: Warmer and windier conditions are forecast for next week, which could further ease electricity prices.

Oil Market Summary

Brent Crude Price:

- 13th–17th January 2025: £80.79/barrel

- 6th–10th January 2025: £76.20/barrel

- Change: +6.03%

Oil prices rose due to U.S. sanctions targeting Russian oil exports and increased heating demand in Europe and the U.S.

Key Highlights:

- Geopolitical Tensions: Expanded U.S. sanctions disrupted Russian oil supply chains, pushing prices higher.

- Cold Weather Impact: Extreme cold in Europe and the U.S. boosted demand for heating oil.

- Future Outlook: The Gaza ceasefire and the upcoming U.S. presidential inauguration could bring further price volatility.

12-Month Wholesale Market Trends

Understanding the Long-Term View

The graph below highlights how wholesale gas (grey line) and electricity (blue line) prices have fluctuated over the past year.

Key Trends:

- Gas Prices: Remain consistently elevated due to seasonal demand and geopolitical factors, with occasional spikes during colder periods.

- Electricity Prices: Volatility is evident, with sharp peaks corresponding to periods of low wind generation and increased reliance on gas-fired power.

What This Means for You:

Both gas and electricity markets are still highly reactive to weather, supply, and geopolitical changes. If your contract end date (CED) is within the next 12 months,

you can secure your next fixed contract now to capitalise on favourable market movements and protect against future price spikes.

Upcoming Week Forecast

Gas Market:

- Milder Weather: Expected from 20th January, which may reduce heating demand and ease prices slightly.

- Continued Storage Withdrawals: Necessary to meet demand, with tight market balances likely persisting.

Electricity Market:

- Improved Renewable Generation: Windier conditions forecast for next week could reduce gas-for-power demand and stabilise electricity prices.

- Lower Heating Demand: Milder temperatures could ease overall electricity consumption.

Oil Market:

- Potential Stabilisation: Prices may stabilise as markets assess the full impact of U.S. sanctions and geopolitical developments.

Recommendation: Is It the Right Time to Renew?

Gas Contracts:

- Short-Term: With slightly elevated prices, consider waiting for milder weather next week before renewing.

- Long-Term: If your contract ends in the next 6–12 months, lock in a fixed rate now to avoid unexpected price spikes.

Electricity Contracts:

- Short-Term: Improved wind generation could ease prices further, making it worth waiting before committing to a renewal.

- Long-Term: Explore early renewal options to secure rates above £100/MWh before further volatility arises.

Fix Early for Better Rates:

Remember, you can secure your next fixed contract up to 12 months before your CED. Taking advantage of current market conditions ensures your business avoids future price uncertainty.

Key Takeaways for Businesses

- Gas Prices: Slightly elevated due to colder weather and geopolitical tensions but may ease next week.

- Electricity Prices: Temporarily stabilised but remain volatile due to renewable generation fluctuations.

- Oil Prices: Higher due to sanctions and increased heating demand but could stabilise as geopolitical events unfold.

Contact us today to secure your energy rates and protect your business from future price surges.

Empower Your Energy Choices

Why Choose Smart Energy Company?

Trusted Expertise

Real-Time Insights

Personalised Support

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business