UK Day-Ahead Electricity Prices Hit Highest Levels Since 2022 – What It Means for Your Business

Why Are Day-Ahead Energy Prices So High? What It Means for Your Business

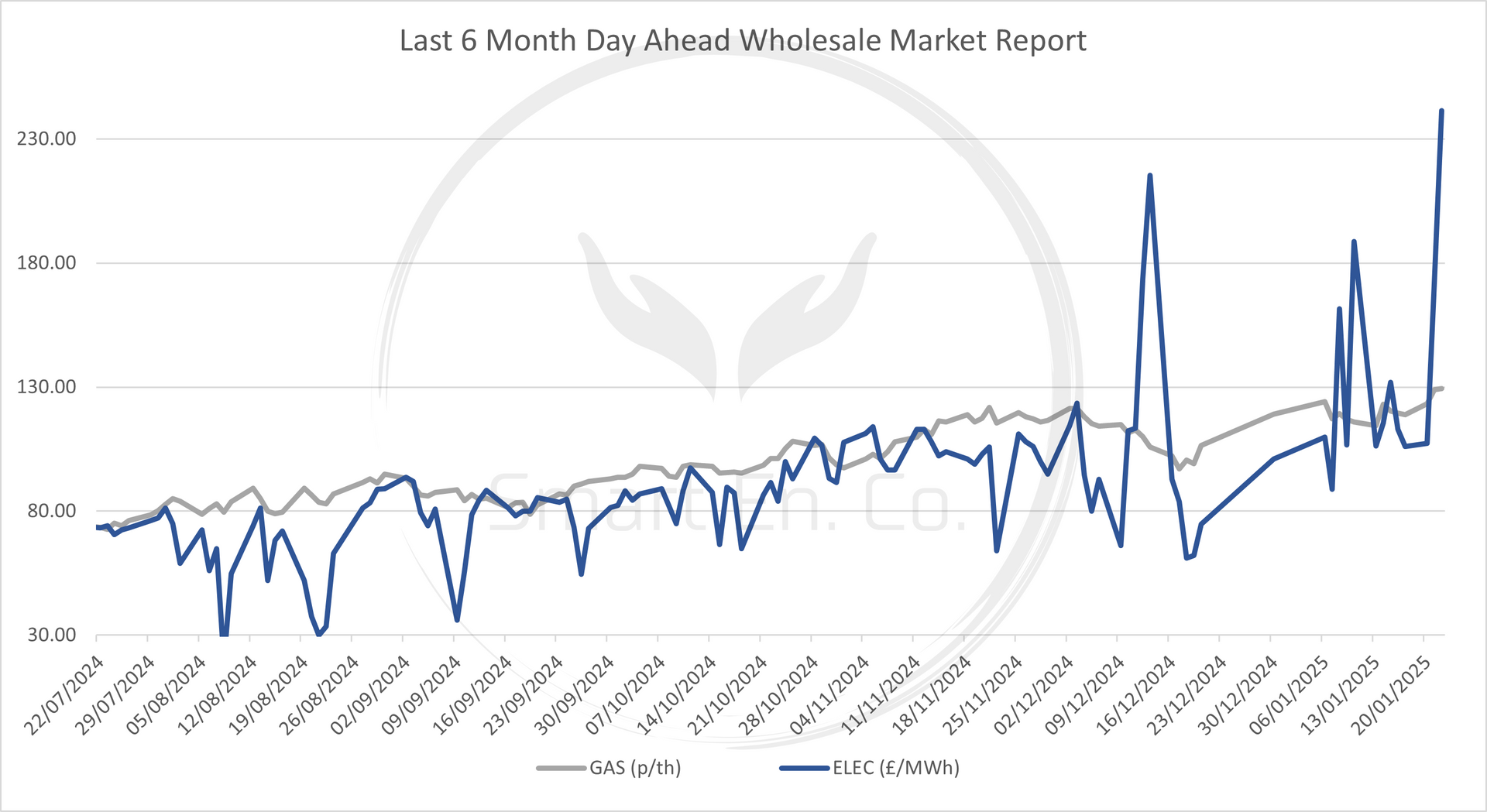

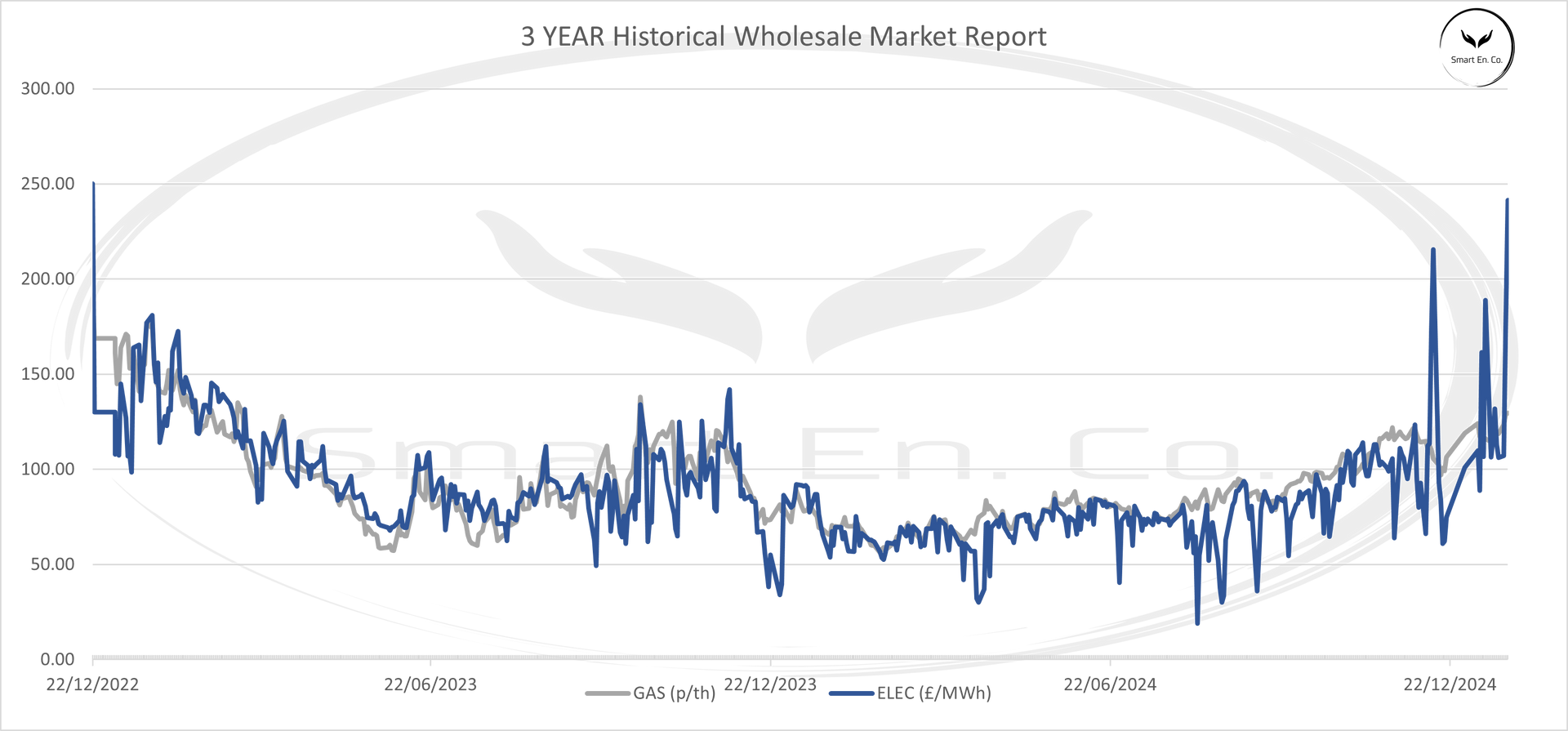

The cost of electricity in the UK for next-day delivery, known as day-ahead prices, has surged to £241/MWh, the highest level seen since the energy crisis in January 2022. These sudden price spikes can significantly impact businesses, particularly those out of contract or due to renew in the foreseeable future!

This blog will explain what day-ahead prices are, why they’ve risen so sharply, and what your business can do to protect itself from future energy cost volatility.

What’s Happening in the Energy Market?

Recent months have seen unprecedented volatility in the UK energy market. The day-ahead electricity price has risen sharply, fueled by colder weather, limited wind generation, and increased demand for gas-fired power. Gas day-ahead prices have also been impacted by concerns over European storage levels and global LNG supply disruptions.

These price movements aren’t just a short-term spike—they signal deeper challenges in the energy market. Businesses need to act now to mitigate the risk of even higher costs in the future.

6-Month Price Comparison

What Can Businesses Do?

To protect against rising energy costs, businesses should consider the following strategies:

- Secure a Short-Term Contract

If you’re unsure about locking in a long-term rate, a 3-6 month fixed contract can provide immediate relief while you monitor market trends. - Explore Long-Term Contracts

Longer-term contracts (2-3 years) currently offer more competitive rates, providing stability and predictability. - Monitor Market Trends Regularly

Keeping track of market reports can help you make informed decisions about when to renew or fix contracts. - Use Renewable Energy

Investing in renewable energy options or choosing green energy tariffs can not only reduce costs but also support your sustainability goals.

Unsure Which Contract is

Right for You?

What’s Driving the Price Surge?

A combination of factors is driving these sharp price increases:

- Weather Conditions: Colder-than-expected temperatures and lower wind generation have increased demand for gas-fired power.

- Storage Concerns: EU gas storage levels are now below 60%, raising fears of insufficient supply for the rest of winter.

- Global LNG Supply: Disruptions in US LNG exports, combined with high Asian demand, are further tightening supply.

Historical Context

How We Can Help

At The Smart Energy Company, we provide tailored solutions to help businesses navigate these challenging times. Our key services include:

- Transparent advice and free market reports delivered to your inbox.

- Flexible contract options ranging from short-term fixes to longer-term stability.

- Expertise in supporting SMEs and I&C clients with customised energy strategies.

Sign Up for Free Market Reports

Conclusion

The UK energy market is entering a period of significant uncertainty. With day-ahead prices hitting multi-year highs, businesses must act decisively to protect against rising costs. Whether it’s exploring flexible contract options or leveraging market insights, now is the time to secure your energy future.

Frequently Asked Questions (FAQs)

How do day-ahead prices differ from front-month or fixed contracts?

Day-ahead prices reflect the cost of energy for the next day, making them highly volatile and dependent on short-term market conditions like weather and supply disruptions. Front-month contracts average prices over a month, providing more stability. Fixed contracts offer even greater predictability by locking in rates for a set period, shielding businesses from day-to-day fluctuations.

If my contract is due for renewal soon, what should I do?

Renewals during high day-ahead price periods can lead to increased costs. Consider securing a short-term contract or reviewing long-term options to lock in competitive rates while market conditions evolve.

What causes day-ahead prices to spike so sharply?

Day-ahead prices are influenced by real-time supply and demand factors, such as extreme weather, limited renewable generation (like low wind output), and global supply disruptions (e.g., LNG shortages).

How can I stay informed about market trends?

You can subscribe to our free market reports, which deliver the latest insights and trends directly to your inbox. These reports help you make informed decisions about your energy strategy.

Don’t Wait for Prices to Climb Higher

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business