Weekly Energy Market Update: 20th - 24th January 2025

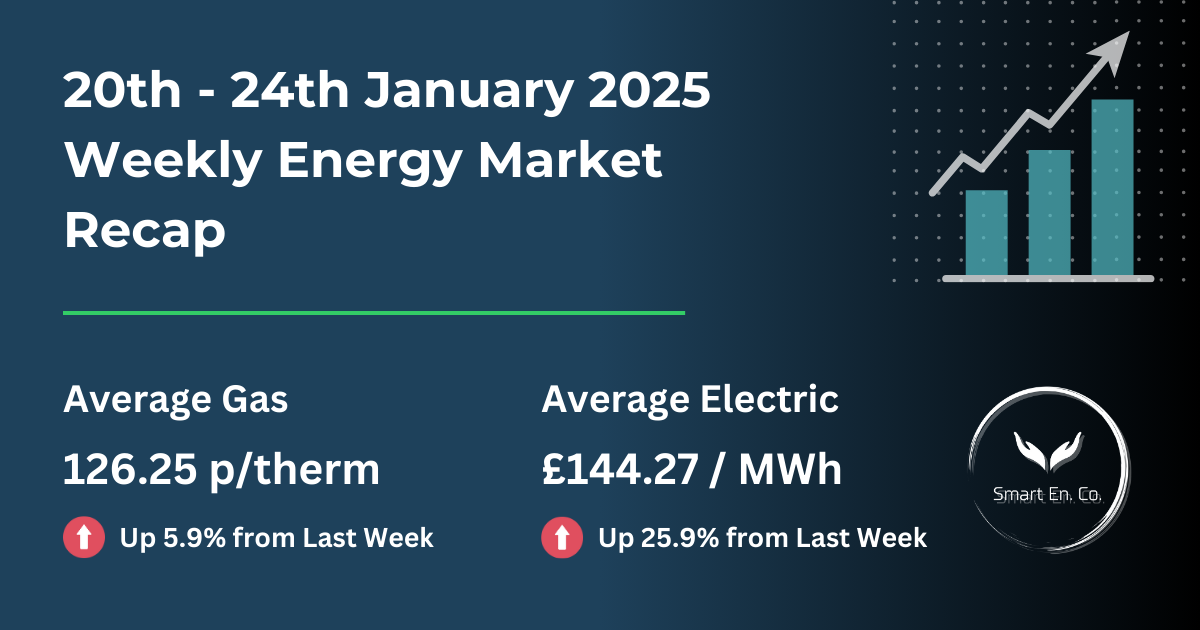

Key Data at a Glance

Overview of the Energy Market Comparison

This week’s energy markets experienced significant movements, with both gas and electricity prices increasing sharply. Gas prices rose by 5.9%, driven by colder weather, weaker wind generation, and geopolitical uncertainty. Electricity prices spiked 25.9%, with fluctuations in wind output and a surge in gas-for-power demand contributing to volatility. Meanwhile, oil prices softened slightly as markets responded to policy changes under U.S. President Donald Trump’s administration.

Gas Market Insights

Average Gas Price:

- 20th–24th January 2025: 126.25p/th

- 13th–17th January 2025: 119.23p/th

- Change: +5.9%

Gas prices rose steadily this week, driven by colder weather, tight supply balances, and interruptions at key facilities.

Key Highlights:

- Demand Drivers:

- A colder weather forecast increased residential and gas-for-power demand, particularly at the start of the week.

- Wind generation was weaker, adding pressure on gas-fired power stations.

- Supply Challenges:

- Early-week interruptions at the Freeport LNG export facility in the U.S. temporarily tightened global LNG markets.

- UK storage began net injections on Thursday for the first time this year, indicating a loosening balance in the coming days.

- Geopolitical Tensions:

- Concerns about Russian LNG exports, U.S. sanctions, and the impact of President Trump’s energy policies added some bullish sentiment.

Daily Movements:

- Monday: Gas prices began at 123.35p/th, reflecting high demand and limited wind generation.

- Tuesday: Prices spiked to 129.5p/th as colder weather in the U.S. affected LNG flows, keeping the market tight.

- Thursday: Prices softened to 125.13p/th as Freeport flows resumed and storage injections began.

Electricity Market Insights

Average Electricity Price:

- 20th–24th January 2025: £144.27/MWh

- 13th–17th January 2025: £114.55/MWh

- Change: +25.9%

Electricity prices rose sharply this week, with midweek volatility driving significant fluctuations due to reduced renewable generation and increased reliance on gas-fired power.

Key Highlights:

- Wind Generation:

- Wind output was lower than forecast early in the week, increasing demand for gas-fired power.

- Later in the week, strong winds improved renewable output, easing some pressure on prices.

- Demand Spikes:

- Colder weather and weaker renewables on Tuesday caused electricity prices to surge to £241.49/MWh, the highest daily price of the week.

- By Friday, electricity demand moderated, bringing prices down to £92.61/MWh.

Oil Market Summary

Brent Crude Price:

- 20th–24th January 2025: £78.29/barrel

- 13th–17th January 2025: £80.79/barrel

- Change: -3.1%

Oil prices softened this week, driven by expectations of oversupply and uncertainty surrounding U.S. energy policy changes.

Key Highlights:

- U.S. Sanctions:

- Broader sanctions on Russian oil producers caused early-week volatility.

- Trump’s Policies:

- Announcements of tariffs and increased U.S. energy production weighed on prices midweek.

- Global Demand:

- Weaker economic activity and energy transitions in the U.S. and China contributed to bearish sentiment.

12-Month Wholesale Market Trends

Understanding the Long-Term View

The graph below highlights how wholesale gas (grey line) and electricity (blue line) prices have fluctuated over the past year.

Key Trends:

- Gas Prices: Continued upward trend driven by colder weather and geopolitical uncertainty. Prices remain higher than the 12-month average.

- Electricity Prices: Volatile, with spikes during low wind generation and colder periods. This week’s spike highlights the impact of extreme conditions.

What This Means for You:

With both gas and electricity prices remaining volatile, businesses should monitor market movements closely. You can secure your next fixed contract up to 12 months before your CED, giving you the flexibility to lock in favourable rates.

Upcoming Week Forecast

Gas Market:

- Milder Weather Ahead: Temperatures are expected to rise, potentially reducing heating demand and easing prices slightly.

- Loosening Balance: Increased storage injections and higher LNG arrivals could stabilise the market.

Electricity Market:

- Improved Renewable Generation: Windier conditions forecast for next week may reduce reliance on gas-fired power.

- Demand Moderation: Milder weather may ease overall electricity consumption, which could bring prices down.

Oil Market:

- Potential Volatility: Continued uncertainty around U.S. policies and global demand could drive small fluctuations.

Recommendation: Is It the Right Time to Renew?

Gas Contracts:

- Prices remain elevated due to tight balances but may ease with milder weather next week.

- Recommendation: Monitor closely and consider renewing if further volatility arises.

Electricity Contracts:

- Prices are volatile but could stabilise as wind generation improves.

- Recommendation: If your CED is within 6 months, consider securing rates soon to avoid further spikes.

Fix Early for Better Rates:

Remember, you can secure your next fixed contract up to 12 months before your CED. Taking advantage of current market conditions ensures your business avoids future price uncertainty.

Key Takeaways for Businesses

- Gas Prices: Higher due to weather and demand but may ease as storage injections increase.

- Electricity Prices: Volatile, with midweek spikes highlighting the impact of renewable generation fluctuations.

- Oil Prices: Stable but influenced by U.S. policies and global demand shifts.

Contact us today to secure your energy rates and protect your business from future price surges.

Empower Your Energy Choices

Why Choose Smart Energy Company?

Trusted Expertise

Real-Time Insights

Personalised Support

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business