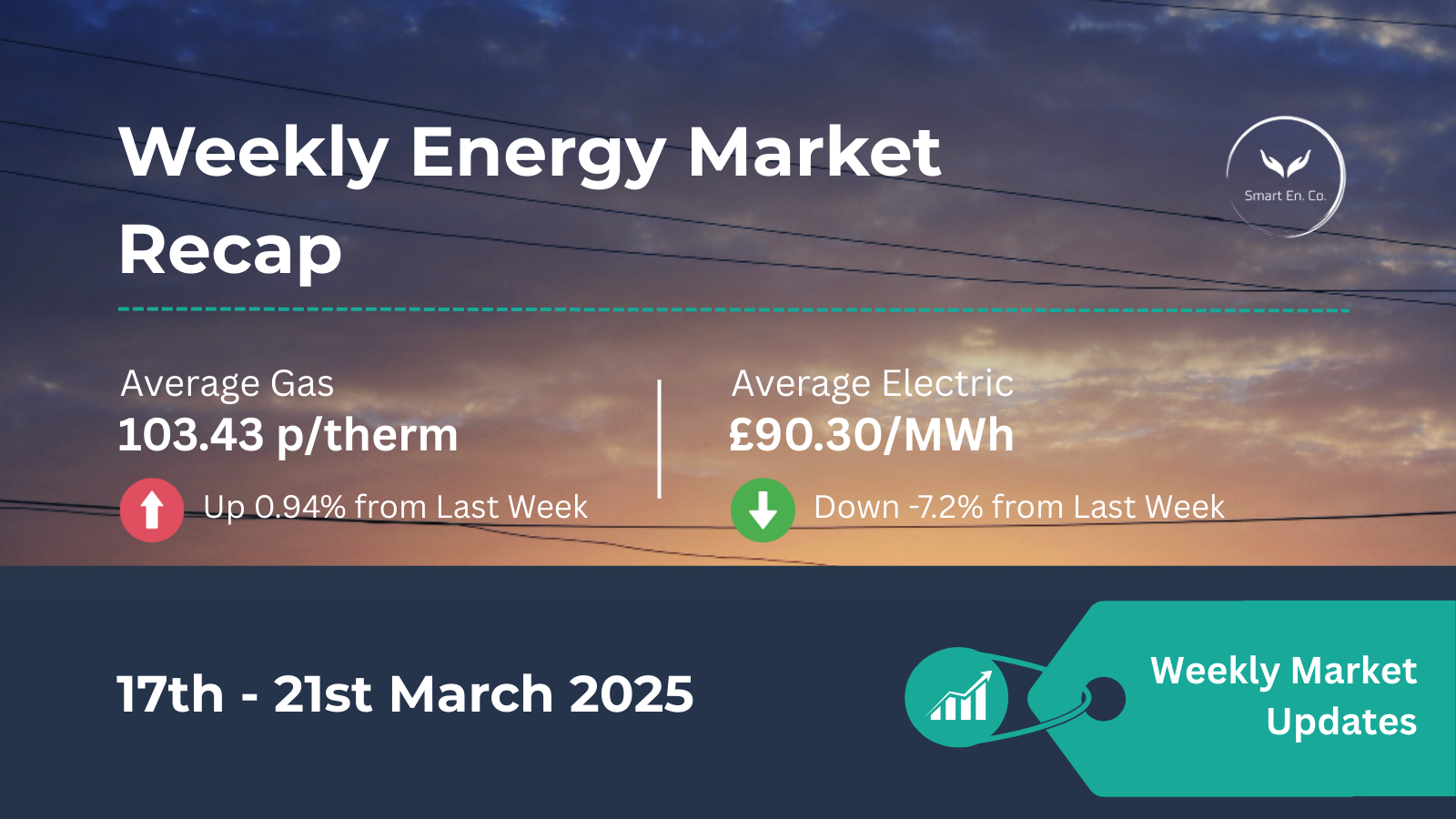

Weekly Energy Market Update: 17th - 21st March 2025

Stay up-to-date on the latest wholesale gas, power, and oil price movements. Here’s a concise overview of what happened this week, why it matters, and how it could affect your next energy contract.

✨ Quick Snapshot

- 🔥 Average Gas: 103.43 p/therm (Up 0.9% vs. last week)

- ⚡ Average Electric: £90.30/MWh (Down 7.2% vs. last week)

- 🛢️

Brent Oil: Closed near $72/bbl, supported by new Iran sanctions and ongoing Middle East tensions.

⚡ Market Overview

- Partial Ceasefire in Ukraine: The proposed 30-day pause in energy infrastructure attacks was only partly observed, leading to a mid-week uptick in gas prices.

- Weather & Supply: Above-average temperatures and solid LNG deliveries helped offset any major price surges, especially in power.

- Volatile Electric Pricing: Electricity dipped sharply on 21/03, skewing the weekly average lower than typical market sentiment.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 106.50 p/therm (20/03) | £99.17/MWh (19/03) |

| Lowest | 100.00 p/therm (19/03) | £63.57/MWh (21/03) |

| Weekly Average | 103.43 p/therm | £90.30/MWh |

| Change vs Last Week | +0.94% | -7.2% |

Note: An unusually low electricity price on 21/03 pulled the weekly average down more than expected.

🔎 Key Drivers This Week

- Ceasefire Uncertainty

- Markets reacted daily to headlines out of Ukraine; partial ceasefire compliance caused a mid-week surge in gas.

- Stable Supply & Mild Weather

- Above-seasonal temperatures and robust Norwegian gas flows tempered the market.

- Power demand softened, reflecting reduced heating needs.

- Oil Market Influences

- Renewed US sanctions on Iran and tension near the Red Sea kept Brent crude supported, indirectly impacting gas/power sentiment.

What Does This Mean for Your Business?

Contracts Ending Soon (0–3 Months)

- Watch for Dips: Sudden drops in power (like on 21/03) can offer favourable locking-in rates.

- If you need budget certainty now, fixing your price on a dip may be beneficial.

Medium-Term (3–6 Months)

- Keep an Eye on Geopolitics: Any escalation could quickly lift prices.

- If the partial ceasefire stabilises further, there may be additional downward room.

Longer-Term (6+ Months)

- Set Target Triggers: You have time to wait, but remain vigilant. Market sentiment can swing on unpredictable events.

⚠️ If you’re out of contract → Acting quickly could save your business money. Standard variable rates are still much higher than fixed rates.

🛢️ Oil Market Roundup

Brent Crude hovered around $70–$72/bbl, ending closer to $72.

Key Factors: US sanctions on Iran, OPEC+ production cuts, and renewed tensions in the Middle East.

Business Impact: While oil prices don’t directly affect most fixed-price electricity/gas contracts, they influence global energy sentiment and logistics costs.

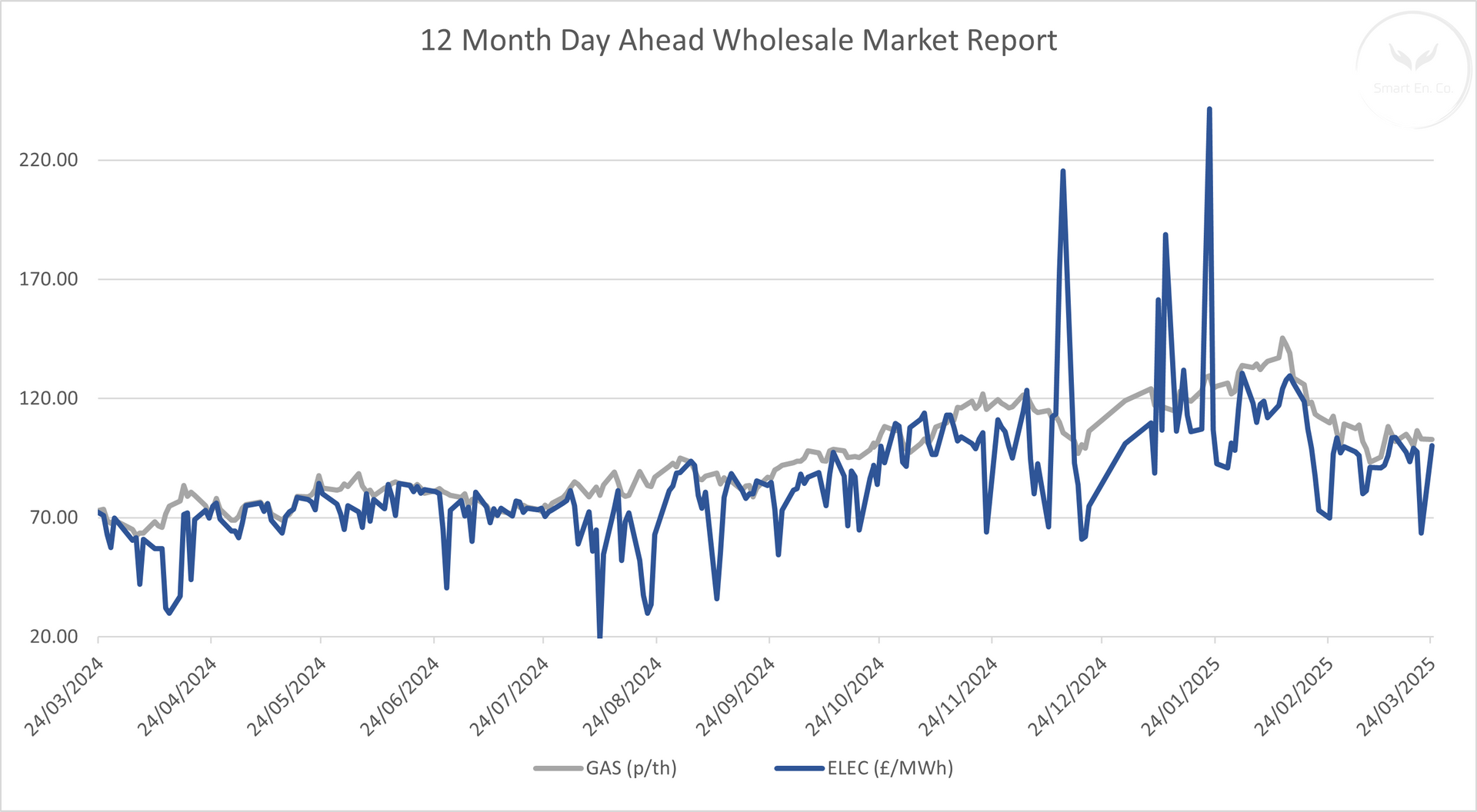

12-Month Energy Market Trends

- Easing from Winter Peaks: Gas and power are lower than the highs seen during colder months.

- Volatile Outlook: Ongoing conflict in Ukraine and Middle East tensions could trigger sudden price moves.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

Final Thoughts

While the winter season is winding down, political uncertainty remains a key driver of energy prices. If your contract is up soon, consider securing a portion of your volume on any dips. For those with more time, monitor developments and set clear price triggers.

📧

Get in touch today to explore your options and ensure your business is on the best possible energy contract.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business