Weekly Wholesale Energy Market Update (Ending 22/11/2024)

UK Weekly Energy Market Update: 18th - 25th November 2024

Overview of This Week's Energy Market

This week has seen significant fluctuations in gas and electricity prices, driven by colder temperatures, increased demand, and geopolitical tensions. Below, we’ll break down the major developments across gas, power, and oil markets, helping you stay informed and plan for your energy needs.

Gas Market Insights

Average Gas Price: 117.91p/th

Gas prices increased notably this week due to a combination of supply disruptions, colder-than-average temperatures, and increased demand for gas-for-power generation.

Key Highlights:

- Colder Weather: As temperatures dipped sharply midweek, demand for gas rose by 17-26mcm/d, with the UK grid under pressure to balance supply and demand.

- Norwegian Supply: Unplanned outages at Norway’s Åsgard field reduced flows to the UK early in the week, although production resumed by Wednesday.

- LNG Boost: LNG sendouts surged to 74mcm/d to compensate for lower pipeline flows, ensuring the UK’s supply remained stable.

Daily Movements:

- Thursday: Gas prices peaked at 121.90p/th, driven by bullish market sentiment and colder temperatures.

- Friday: Prices softened slightly to 115.50p/th, as temperatures began to normalise and supply from Norway increased.

Power Market Insights

Average Electricity Price: 94.55 £/MWh

Electricity prices fell slightly this week, influenced by increased wind generation and warmer weather forecasts for late November.

Key Highlights:

- Wind Generation: Forecasted wind output surged to 16.5GW/day, reducing reliance on gas-fired power generation.

- Demand Fluctuations: Power demand dropped midweek due to above-average temperatures but remains volatile due to colder spells forecasted for December.

- Bullish Midweek: Electricity prices peaked at 105.75 £/MWh on Thursday, as low wind speeds coincided with higher heating demand.

Oil Market Insights

Brent Crude Average: ~$73.30/barrel

The oil market experienced volatility due to geopolitical tensions and fluctuating global supply conditions.

Key Highlights:

- Geopolitical Risks: The Russia-Ukraine conflict escalated, with missile strikes from both sides raising concerns about potential disruptions to crude oil supplies.

- Norwegian Production: The Johan Sverdrup oilfield resumed operations midweek after a brief outage, stabilising global supply.

- End-of-Week Rally: Oil prices rebounded on Friday to $74.23/barrel, supported by risk premiums from the ongoing conflict.

Weekly Trends and Analysis

Gas and Power Price Movements:

Compared to last week, gas prices rose by 4.3%, reflecting increased heating demand due to colder-than-average temperatures.

Electricity prices fell by 1.6%, largely due to stronger wind generation and above-average temperatures towards the end of the week.

Market Outlook for Next Week:

- Temperatures: A brief return to seasonal normals is expected, followed by another cold spell in early December, which could drive demand higher.

- Supply: LNG cargo arrivals and Norwegian pipeline flows are expected to stabilise, maintaining a comfortable supply position.

- Geopolitical Factors: Continued tensions in Ukraine and the Middle East could add volatility to gas and oil markets.

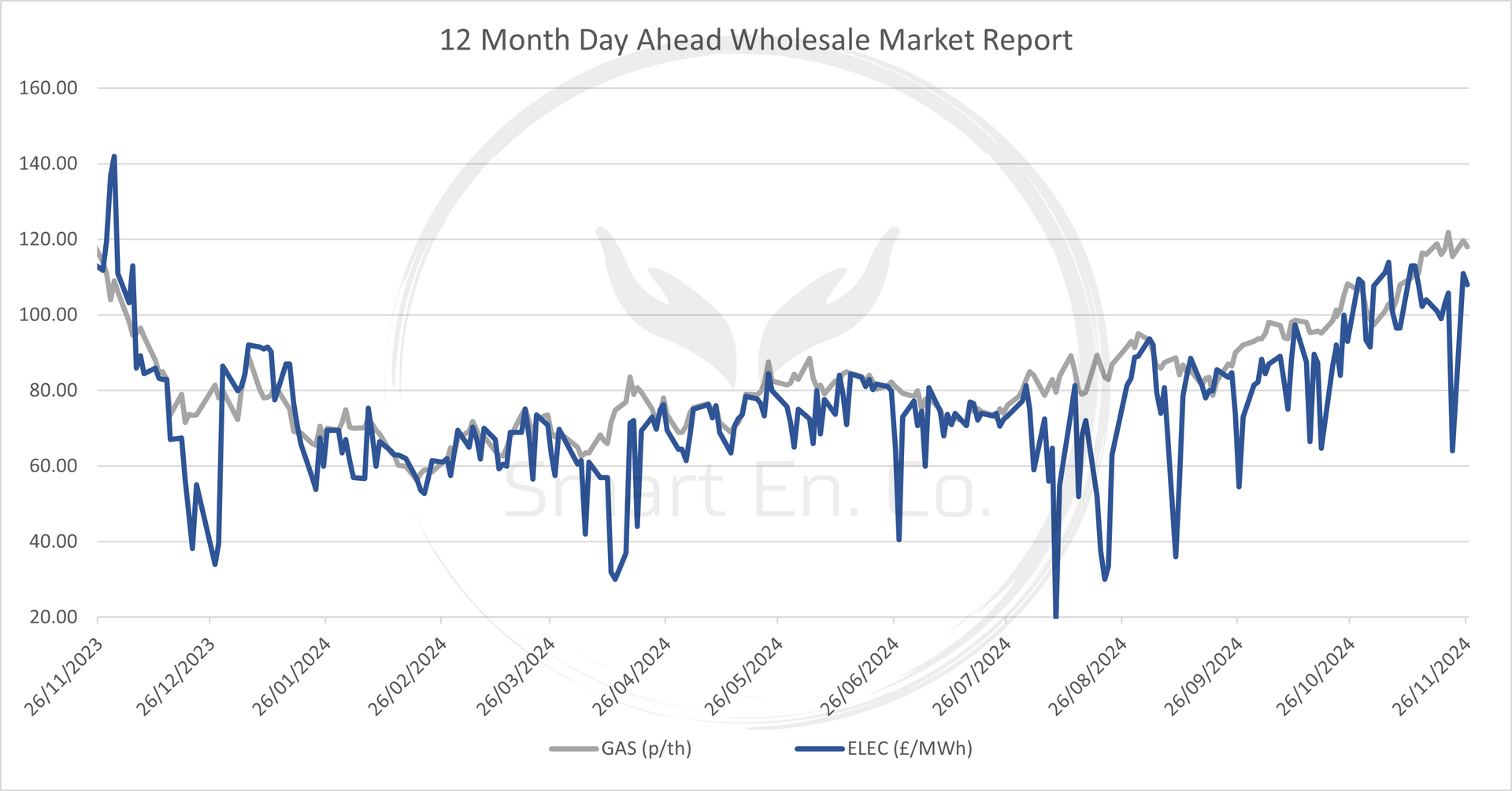

Charting the Bigger Picture

Last 12 Months: Energy Market Movements

Over the past year, both gas and electricity prices have shown significant volatility. This week’s price increases reflect a broader trend of supply-side pressures during colder months.

What This Means for Your Business

Volatility in the energy markets continues to highlight the importance of locking in favourable rates. At The Smart Energy Company, we monitor market movements daily to help businesses like yours secure the best deals at the right time.

Stay Ahead of the Market

To receive updates like these straight to your inbox or get expert advice on securing the best energy rates, sign up for our free market insights or get a quote today.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business