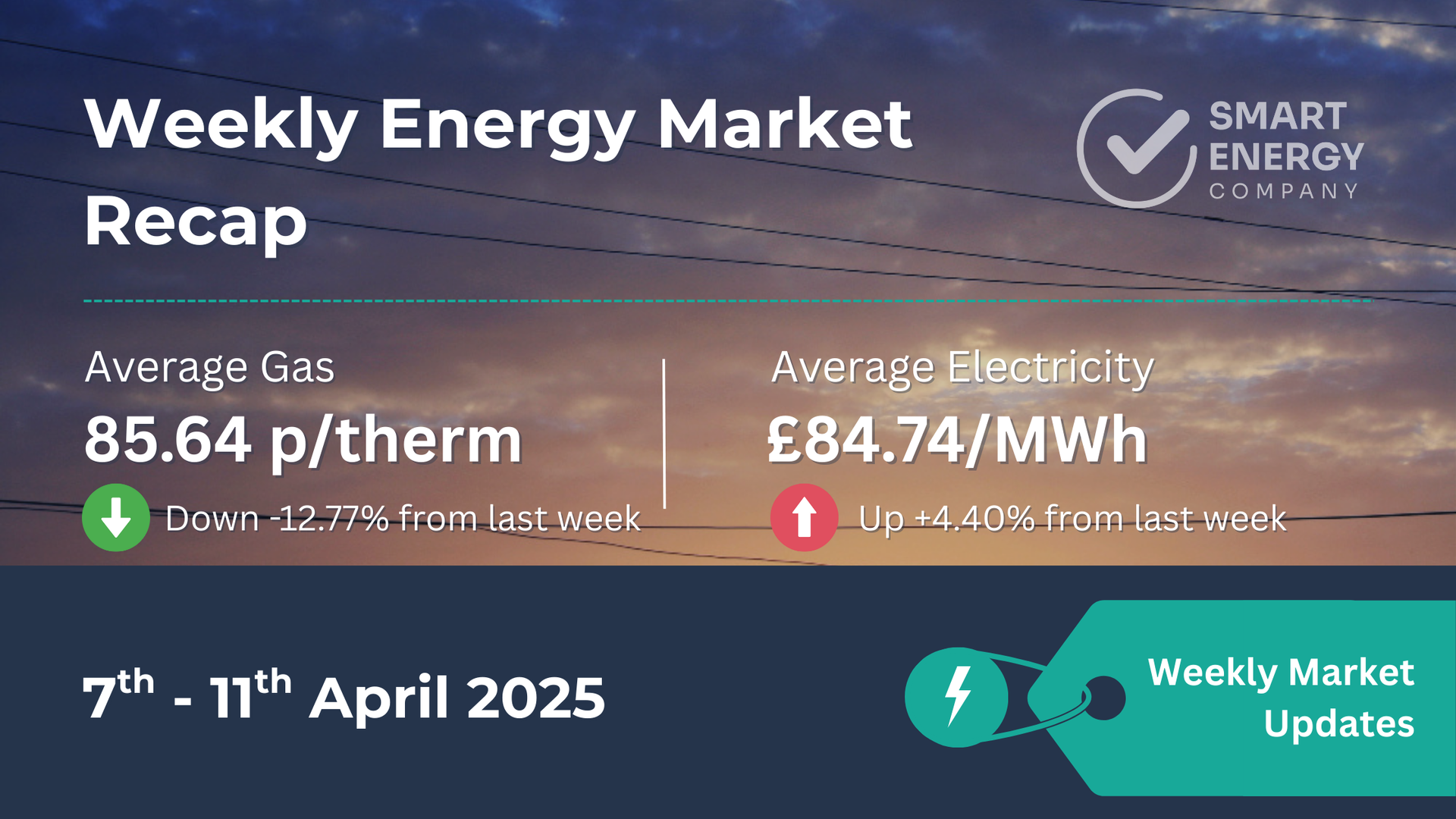

Energy Market Update: 7th - 11th April 2025

Stay up-to-date on the latest wholesale gas, power, and oil price movements. Here’s a concise overview of what happened this week, why it matters, and how it could affect your next energy contract.

✨ Quick Snapshot

- 🔥

Average Gas (Day-Ahead):

85.64 p/therm

(Down ~12.77% from last week’s 98.18 p/therm)

- ⚡

Average Electric (Day-Ahead):

£84.74/MWh

(Up ~4.40% from last week’s £81.17/MWh)

- 🛢️ Crude Oil: Ended the week near $60/bbl, marking a steep drop driven by global trade tensions and escalating tariffs.

Note: Gas prices plunged to a 6-month low at one point this week, largely influenced by mounting trade war concerns and the possibility of a global recession. Meanwhile, power prices rose slightly on the back of supply adjustments and day-to-day volatility.

⚡ Market Overview

Tariffs Fuel Volatility

- China’s Retaliation: Additional tariffs on U.S. goods triggered steep market drops early in the week, hitting energy commodities particularly hard.

- NBP & TTF: UK and Dutch gas prices saw swift declines of over 6% at times, followed by intraday rebounds whenever new tariff rumors or clarifications emerged.

Flip-Flop Trading

- Markets experienced wide intraday swings (e.g., 7% down then recovering by day’s end).

- Incorrect reports about a possible 90-day tariff pause briefly lifted prices, though they later dipped again as the White House dismissed those rumors.

Oil Slides to Multi-Year Lows

- Brent crude dropped to around $60/bbl, its lowest in over 3 years, as traders braced for weaker global demand under extended tariff regimes.

- A late-week announcement of a 90-day tariff pause led to a short-lived price rise, but sentiment remained shaky.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 89.50 p/therm (07/04) | £90.18/MWh (07/04) |

| Lowest | 81.35 p/therm (11/04) | £70.94/MWh (Previous Week)* |

| Weekly Average | 85.64 p/therm | £84.74/MWh |

| Change vs Last Week | -12.77% | +4.40% |

Note: Gas plummeted more than 12% week-on-week, while power rose around 4%. Fluctuating tariff announcements, a cooler start to the week, and changing supply/demand dynamics contributed to these diverging trends.

🔎 Key Factors This Week

1. Ongoing Trade War & Tariffs

- Energy markets reacted instantly to headlines about new tariffs on imports.

- China’s retaliatory measures and additional U.S. tariff hikes stoked fears of a recession, pushing gas lower.

2. Intraday Volatility

- Rumors of a tariff pause caused rapid buying sprees, only to be reversed once the White House dismissed them.

- Norway’s announced maintenance extensions had minimal impact as tariff news overshadowed supply updates.

3. Shifting Power Prices

- Despite falling gas, UK power inched higher on certain days, partly due to variation in wind output and short-term demand shifts.

- Overall, daily swings were milder in electricity than in gas, but still noticeable.

🏢 Implications for Your Business

- Contracts Ending Soon (0–3 Months)

- With gas at a multi-month low, it may be a prime moment to fully fix your rates. However, keep in mind the market’s tendency to swing on trade headlines.

- Medium-Term (3–6 Months)

- Monitor events closely. If a major agreement or resolution in trade talks emerges, prices could rebound. On the other hand, prolonged tensions might keep gas prices under pressure.

- Long-Term (6+ Months)

- If you have flexibility, set price alerts to act quickly on any dips. Prolonged tariff disputes and potential global economic slowdown could influence energy pricing well into next year.

🛢️ Oil Market Brief

- Brent Crude dipped near $60/bbl, the lowest level in over three years, driven by trade war uncertainty.

- Key Observations:

- China remains the world’s largest oil importer, so heavy tariffs on Chinese goods can weaken demand expectations.

- A brief rally followed the 90-day tariff pause announcement, but it quickly faded as massive tariffs remain in place.

While oil doesn’t directly set UK gas or power prices, its slump reflects broader concerns about a global economic slowdown and reduced energy consumption.

📈 12-Month Energy Market Trends

Gas and power prices have come down from winter highs, but remain highly reactive to geopolitical shifts. Intraday volatility is particularly acute when new tariff or trade war updates surface. The coming weeks may reveal whether these tensions persist or if negotiations calm the markets.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

Escalating tariffs and

volatile trading defined this week’s energy landscape. Gas took a sharp tumble, creating a window for businesses looking to lock in budget certainty. Power prices rose modestly, so if you rely heavily on electricity, now is an important time to assess your options.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business