Energy Market Update: 31st March - 4th April 2025

Stay up-to-date on the latest wholesale gas, power, and oil price movements. Here’s a concise overview of what happened this week, why it matters, and how it could affect your next energy contract.

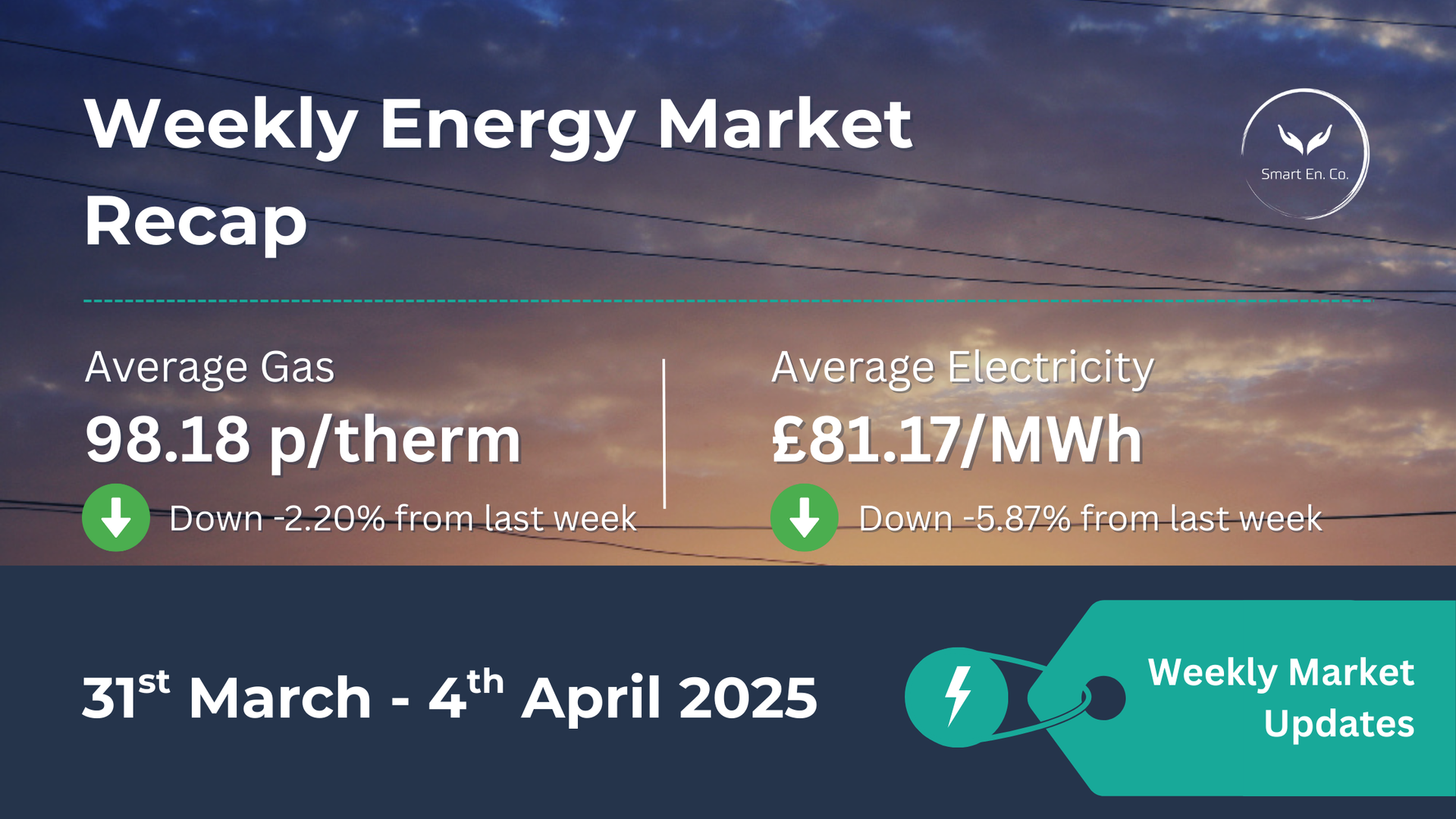

✨ Quick Snapshot

- 🔥

Average Gas (Day-Ahead): 98.18 p/therm

(~2% lower than last week’s 100.37 p/therm)

- ⚡

Average Electric (Day-Ahead): £81.17/MWh

(~5.7% lower than last week’s £86.08/MWh)

- 🛢️ Brent Crude: Fell sharply to near $70/bbl on Thursday, reversing earlier gains amidst global trade tensions and OPEC+ announcements.

Note: After a brief mid-week spike (when Norwegian maintenance and cooler forecasts hit), gas prices resumed a downward trend as winter demand winds down.

⚡ Market Overview

Shifting Supply & Summer Transition

- UK and Dutch gas started the week mixed on fresh attacks near Sudzha (a Russian supply point) offset by improving weather.

- By week’s end, milder temperatures and lower demand pulled prices back below the 100 p/therm mark.

Geopolitics & “Liberation Day”

- The US announced new tariffs (dubbed “Liberation Day”), rattling global markets.

- Energy commodities were exempt, but economic slowdown fears weighed on prices overall.

No Ceasefire Deal

- Putin’s refusal to accept a US-backed Ukraine ceasefire boosted prices temporarily.

- As the week progressed, attention shifted to

trade measures rather than direct military escalations, calming the market.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 102.60 p/therm (02/04) | £96.04/MWh (31/03) |

| Lowest | 95.78 p/therm (04/04) | £70.94/MWh (03/04) |

| Weekly Average | 98.18 p/therm | £81.17/MWh |

| Change vs Last Week | -2.20% | -5.87% |

Note: Warmer weather, stable supply, and trade-related uncertainty contributed to the overall decline in prices compared to last week.

🔎 Key Factors This Week

1. Weather & Demand

- Above-seasonal temperatures moderated heating needs.

- Brief cooler forecasts, plus Norwegian maintenance, created a mid-week spike in gas before prices eased again.

2. Norwegian Maintenance & Storage

- Maintenance affected flows but didn’t outweigh lower demand.

- Market focus now shifts to refilling storage for next winter, though current demand softness reduces urgency.

3. Global Trade Tensions

- The US introduced sweeping tariffs without targeting energy directly.

- Concern over economic growth weighed on prices, especially mid-to-late week.

🏢 Implications for Your Business

- Contracts Ending Soon (0–3 Months)

- Lower prices could make this an opportune moment to fix. Keep in mind sudden geopolitical changes can reverse the trend.

- Medium-Term (3–6 Months)

- Monitoring the market is sensible; any ceasefire breakthrough or new tariffs could jolt prices.

- Long-Term (6+ Months)

- You have time to watch the market further. Setting price alerts can help you catch potential dips while managing risk.

🛢️ Oil Market Brief

- Brent Crude hovered near $70/bbl on Thursday, dropping 6% in a single day—the steepest fall in three years.

- Key Influences:

- OPEC+ boosted its planned output hike from 135,000 to 411,000 bpd.

- Fears of a global economic slowdown escalated as new US tariffs were announced.

- Earlier in the week, the possibility of sanctions on Russian and Iranian oil had kept prices elevated.

Although oil prices do not dictate UK gas or power directly, they reflect the broader energy market’s mood and the global economic outlook.

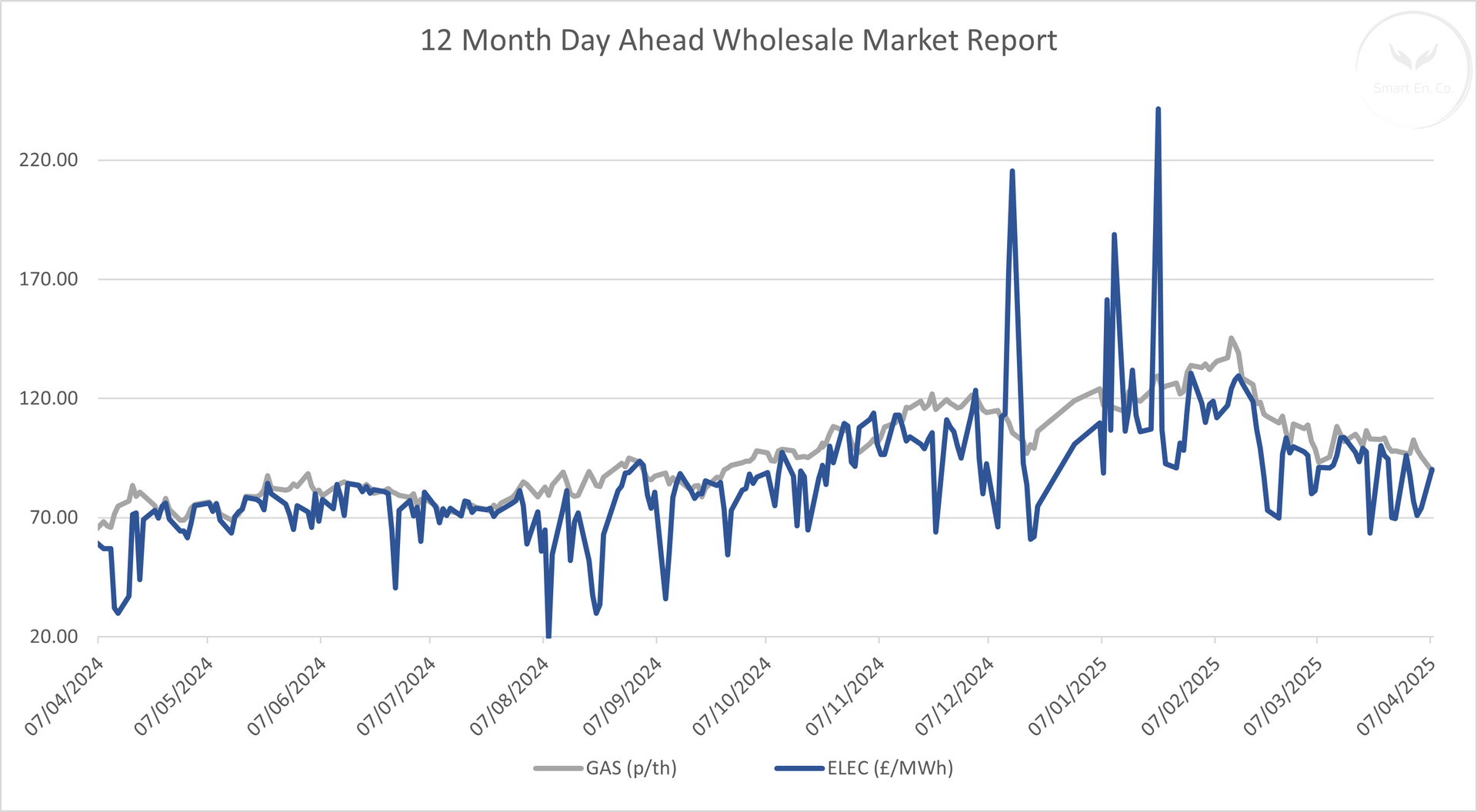

📈 12-Month Energy Market Trends

Prices have generally eased from winter highs, but remain sensitive to new supply disruptions or shifts in trade policy. Storage refill strategies and any Ukraine developments will shape short-to-mid-term volatility.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

With the winter season behind us, gas and power prices have drifted lower. However,

global trade tensions and the evolving situation in Ukraine mean quick changes are still possible. If you’re nearing renewal,

fully fixing your rates while prices are down can offer long-term budget certainty.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business