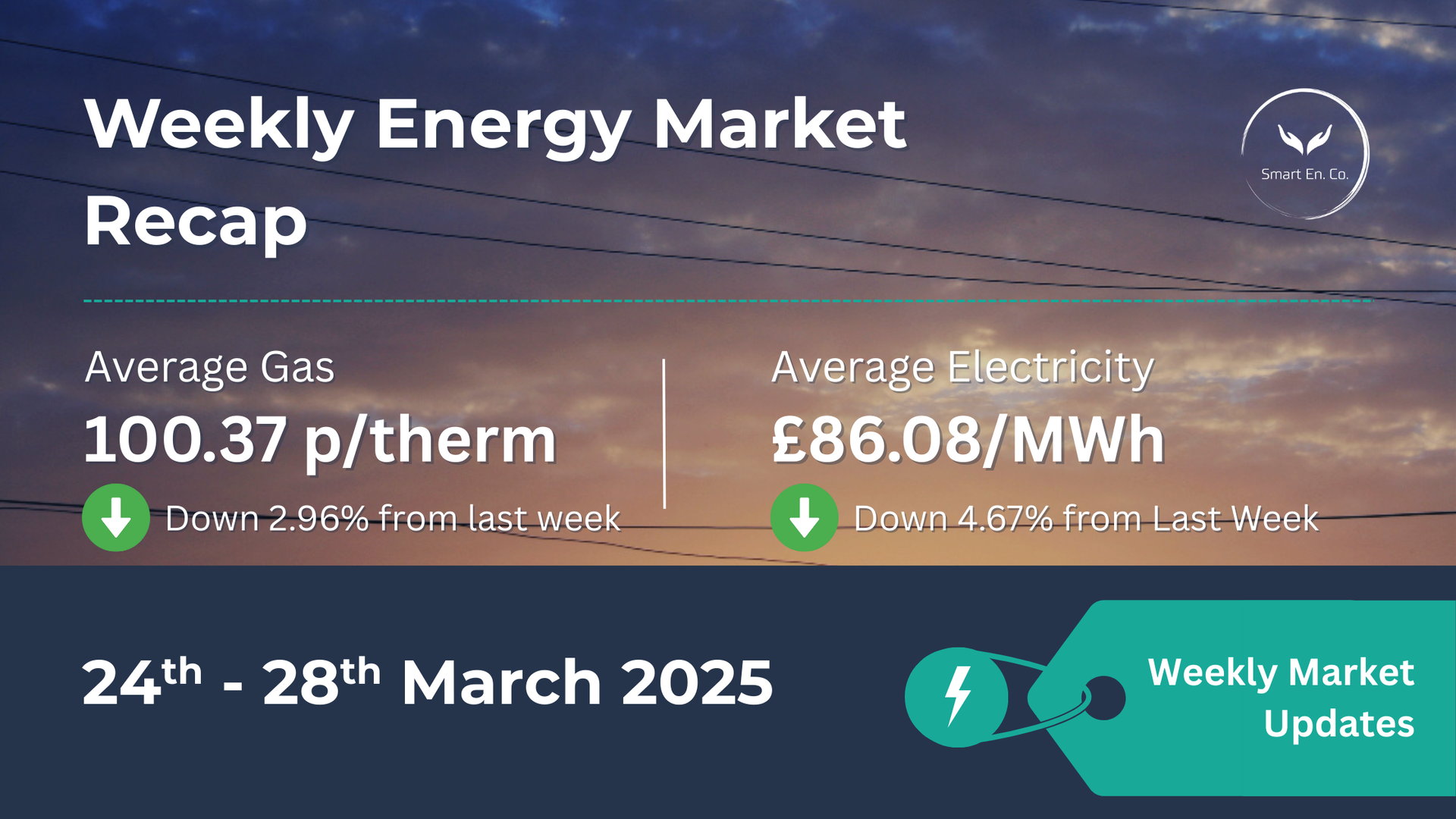

Weekly Energy Market Update: 24th - 28th March 2025

Stay up-to-date on the latest wholesale gas, power, and oil price movements. Here’s a concise overview of what happened this week, why it matters, and how it could affect your next energy contract.

✨ Quick Snapshot

- 🔥

Average Gas (Day-Ahead): 100.37 p/therm

(Down ~3% from 103.43 p/therm last week)

- ⚡

Average Electric (Day-Ahead): £86.08/MWh

(Down ~5% from £90.30/MWh last week)

- 🛢️ Brent Crude: Ended near $74/bbl, up slightly from last week as new sanctions and OPEC+ moves suggest tighter supply ahead.

Note: As of 31st March (this morning), gas briefly jumped to around 96.04 p/therm. Expect short-term shifts as geopolitical news continues to develop.

⚡ Market Overview

- Sudzha Gas Station Strike Rumours

- Early in the week, reports of a strike on the Sudzha station (a key entry point for Russian gas into Ukraine) caused a brief price surge.

- Lack of official confirmation led traders to revise initial assumptions, sending prices lower by midday.

- Mild Weather & Supply Outlook

- Temperatures remain above seasonal norms, reducing gas demand for heating.

- Additional LNG cargoes and the return of UK nuclear capacity from maintenance pressured both gas and power prices downward.

- Ceasefire Talks & Maritime Agreements

- Discussions of a possible pause in energy infrastructure attacks between Russia and Ukraine briefly eased market tension.

- Details remain uncertain; any sustained truce could keep prices from rising sharply.

- Looking Ahead to Summer

- With milder weather on the horizon, gas demand may soften further unless a cold snap or supply issue disrupts the market.

📊 Weekly Prices at a Glance

| Gas (Day-Ahead) | Power (Day-Ahead) | |

|---|---|---|

| Highest | 103.50 p/therm (25/03) | £100.17/MWh (24/03) |

| Lowest | 97.80 p/therm (27/03) | £69.64/MWh (28/03) |

| Weekly Average | 100.37 p/therm | £86.08/MWh |

| Change vs Last Week | Down ~3% | Down ~5% |

Note: Mild weather, strong supply, and mixed signals from geopolitical talks all contributed to this week’s lower averages.

🔎 Key Factors This Week

- Weather & Demand

- Above-normal temperatures translated into reduced heating needs.

- Variable wind forecasts, stronger solar output, and stable Norwegian flows helped keep prices in check.

- Geopolitical Developments

- Meetings in Saudi Arabia aimed at reducing attacks on energy targets lowered market anxiety in the short term.

- Possible changes to sanctions on Russian exports remain a wild card that could quickly shift prices.

- Maintenance & Supply Adjustments

- Two UK nuclear plants are back online, boosting power supply and reducing gas demand for electricity generation.

- Norwegian gas flows have adjusted to match slightly lower demand, while LNG arrivals helped keep the UK system comfortable.

🏢 Implications for Your Business

- Contracts Ending Soon (0–3 Months)

- Recent drops could present a buying opportunity. However, prices may jump if ceasefire talks fail or a supply issue emerges.

- Medium-Term (3–6 Months)

- Mild weather and stable supplies may keep prices lower, but be prepared for sudden reversals if geopolitical events escalate.

- Long-Term (6+ Months)

- More time to watch the market. You might consider setting price alerts or partial fixes if you want to capture potential dips while managing risk.

🛢️ Oil Market Brief

- Brent Crude hovered around $74/bbl, a modest lift from the previous week.

- Key Influences:

- New US Sanctions on Iran (including penalties on some Chinese refiners).

- OPEC+ indicating continued or expanded output cuts.

- Proposed US Tariffs on buyers of Venezuelan crude, adding trade uncertainty.

Although oil’s trajectory doesn’t directly set UK gas/power prices, it reflects the broader energy market mood—heightened volatility due to political tensions.

📈 12-Month Energy Market Trends

Prices have eased from winter highs, but rapid swings remain possible. Ceasefire progress or renewed conflict in Ukraine, along with weather surprises, could quickly change the outlook.

📊 (See the 12-month market graph below for a full breakdown of movements.)

🔭 Next Steps

Ready to Lock in Better Rates or Stay Ahead of the Market?

Our experts monitor global energy movements so you don’t have to—take control now.

🤝 Final Thoughts

With prices trending down this week, businesses approaching renewal might find it a

timely moment to lock in. However, the

ever-shifting geopolitical landscape means surprises can’t be ruled out. Setting trigger points or partial fixes can help you balance risk and flexibility.

Explore More Insights

Dive into more energy updates, market reports, and supplier insights tailored for your business